Are you still performing competitor research like you did three, four, even five years ago? Are you crafting your (or your client’s) SEO plan the same way based on what you find? If so, then it’s time to update your strategy. The world of SEO has changed dramatically, and your competitive research should reflect that change. Here’s what you should be looking for when researching competitors, and how to use that information to create a penalty-proof SEO plan.

Links

Just because the competitor is ranking well with tons of spammy, irrelevant links doesn’t mean you should follow suit. If they haven’t been penalized yet, they might get it in the future. Instead, find out the following.

What is Your Competitor’s Overall Strategy?

Look for the best trends in the competitor’s link building profile. Do they have lots of great guest posts on industry blogs? Do they have a strong local presence? Do major media outlets regularly mention them? These are the things you will want to emulate, not low-quality directories, blog comments, forum signatures, and over-optimized press releases.

What Are the Best Links They Have Obtained?

If you or your client has a strong website, aim to get the best links your competitor has obtained as soon as possible. Start with gathering their best links, and then go for even better ones. If Google continues to penalize websites with lots of low quality links, then the ones with fewer but higher quality links (like yours) will be able to shine through.

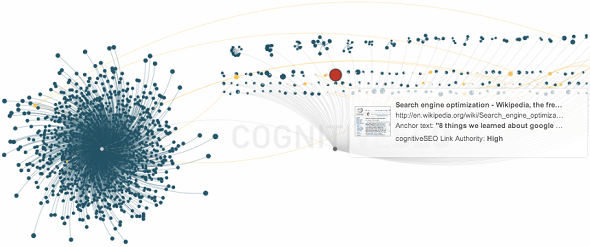

One easy way to spot your competitors best backlinks is by using tools like CognitiveSEO. Their visual backlink explorer displays high quality links with larger dots.

(Screenshot taken 11/26/2013 of http://cognitiveseo.com/)

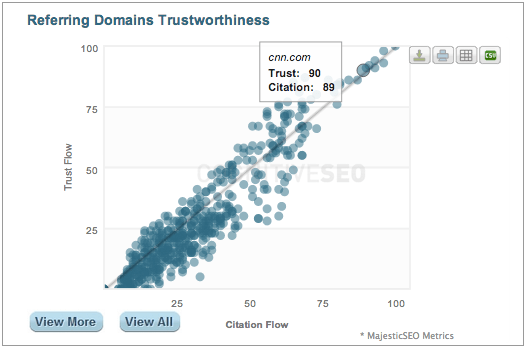

You can also use the Domain Trustworthiness graph to see the highest authority domains linking to your competitors.

(Screenshot taken 11/26/2013 of http://cognitiveseo.com/)

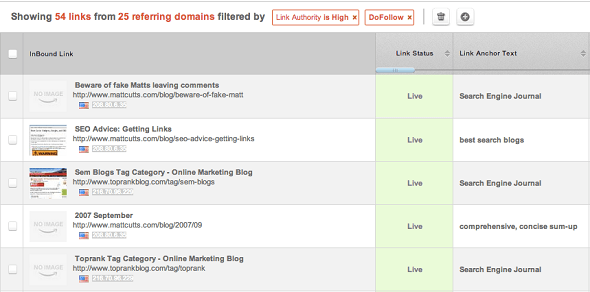

If you prefer an exportable chart, you can filter the backlinks of your competitors by authority and only view the high authority links.

(Screenshot taken 11/26/2013 of http://cognitiveseo.com/)

Depending on your industry, you’ll likely find the highest authority links are from .gov or .edu sites, the top blogs in the industry, media networks, and other well-respected sites.

In order to gain these links for yourself, you will need to:

- Build relationships with the top industry blogs that will publish your content as a guest or regular contributor.

- Build strong profiles on local sites and properly encourage customers to write reviews.

- Sign up for HARO and similar networks that connect you to journalists so you can contribute your knowledge in exchange for a mention and a link.

Content

Gone are the days when 300 words of keyword-optimized text were all you needed to get a page ready for your target keywords. Google is not going to reward you for having thousands upon thousands of over-optimized articles on your website. They are going to reward you for having hundreds of high-quality, reader-focused blog posts. Not only that, but they are also going to reward you for having authoritative authors creating that content. When you’re researching the competitor’s content, here are the questions you need to ask.

Who are the authors?

If author rank isn’t playing a role in rankings now, it certainly will be in the future (according to Matt Cutts at least). A part of your competitor research should be focused on who the authors of the competitor’s content are, and how strong are they as authors. Find their Google+ profiles and look at the other sites they’ve written for, how often they are creating content, how many followers they have on Google+, and how much engagement they receive on their Google+ posts.

One tool that can help with this process is the SEOchat Author Links Crawler (free, but currently in beta). You can use it to see what authors are linking to specific sites in order to connect with influential people in your industry. Reach out to them and see if you can get them to create content for you.

What is the length of the average piece of content?

While length isn’t everything, it can certainly help you determine how in-depth competitors go with their content. If their content ranks well in search, and it is generally 1,000 – 2,000 words per piece, but your content or your client’s is only 500 – 600 words per piece, you might want to look into creating more extensive pieces of content.

How much engagement do they receive?

Does social engagement with content have anything to do with rankings? Maybe, especially if you consider that the more a piece of content is shared on social networks, the more likely bloggers and journalists are to pick it up and link to it on their own websites. See if you can follow the promotional strategy for some of the competitor’s top pieces of content. Who tweeted it, how it was shared on Facebook, where it was bookmarked, and what sites linked to it? Answering those questions can help you build a sound promotional strategy for your content, or your client’s.

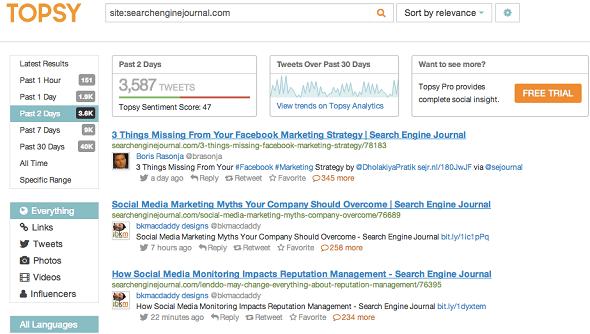

One tool that can help you see the content that receives the most engagement on social media – Twitter in particular – is Topsy. Use the following URL and replace searchenginejournal.com with your competitor’s domain.

http://topsy.com/s?q=site%3Asearchenginejournal.com

You will then see their content links along with the number of tweets each link has received.

(Screenshot taken 11/25/2013 of http://topsy.com)

You can click on each piece of content to see who tweeted it, and then do a search on Google for the title of the post to find out other networks the article has been shared upon or linked. This will help you identify their promotional strategy.

Social Media

Having a strong social media presence can be a great asset, especially since you don’t want to put all of your eggs in an organic search basket. If social media isn’t a part of your competitor research, then make sure it does! Ask the following questions.

What networks do the competitors use?

Not what networks do competitors have a profile on, but what networks do they actively use. You’ll generally find that most are active on Facebook, Twitter, LinkedIn, Google+, and Pinterest (usually in that order). Also be on the lookout for any niche-specialized social networks and forums that the competitors are using on a regular basis. To find this out, you can simply use Google to search for the competitor’s name – their top social profiles will generally come up in the first couple of pages.

How many followers / fans do they have?

Do you need 1,000 fans, 10,000 fans, or a million fans? Find out by seeing how many people the competitors have in their social networks. If you’re looking for a selling point of why a business should be on social media, this number could play an important role as it shows the number of potential customers that can be found on social media.

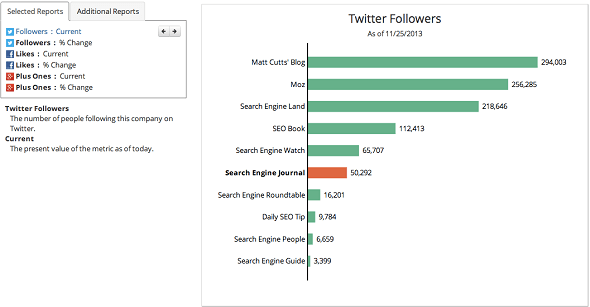

Aside from visiting each of the competitor’s social profiles and noting their audience size, one great tool to use to quickly see a group of competitor’s followers and fans is Rival IQ. It allows you to compare the size of your competitor’s audience on Twitter, Facebook, and Google+.

(Screenshot taken 11/25/2013 of https://www.rivaliq.com/)

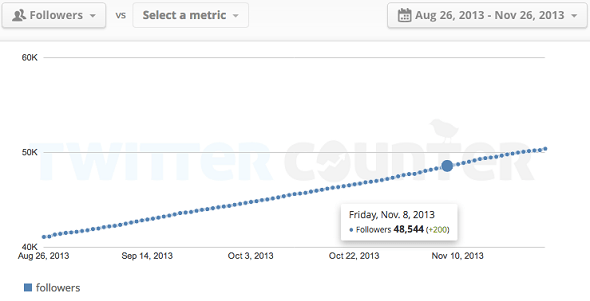

You can also use tools like TwitterCounter to see the growth of your competitor’s Twitter following over the time span of up to three months for free, or up to six months with a preview of their premium service by paying with a tweet.

(Screenshot taken 11/26/2013 of http://twittercounter.com/)

One of the things this will quickly reveal is if your competitor has had any major growth spikes, which is sometimes indicative of a purchase of followers.

Of course, don’t stop there…

How much quality engagement do they receive?

Anyone can buy fans and followers. They can even buy engagement. But they can’t buy true interactions. If you are looking to craft your social media strategy based off of how competitors are using social media, be sure that you are modeling yours and your client’s on a competitor that is receiving true engagement from their audience.

How often do they update each of their networks?

This revolves back to content, except in this case, it’s social media content. How many times do competitors update each of their social networks, and how do they do it? Do they ask questions, post links, and/or share photos and videos? And most importantly, what types of updates get the most engagement from their audiences?

You may not be able to tell their ROI, but there’s a good chance that the more exposure they get on a status update, the more likely that update is to convert compared to one with little to no response.

What do you include as part of your competitive research strategy?

Featured Image Credit: http://www.dreamstime.com/