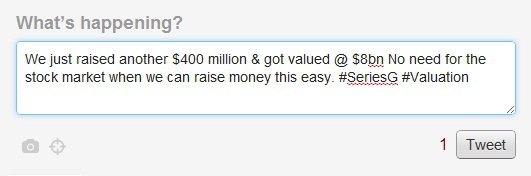

After recently indicating that Twitter is not planning for an IPO in the near future, CEO Dick Costolo is set to close the second of two $400 million rounds of Series G funding later today. This round, which is primarily intended to buy out existing shareholders, has catapulted Twitter’s valuation to a new height of $8 billion. During a press conference on Thursday, Twitter executives emphasized their desire to focus on growth rather than on pleasing stock market investors.

Twitter, which has seen exceptionally high advertisement engagement rates from its users, is exploring additional monetization methods. During a recent press conference, Costolo indicated that Twitter is planning to increase users’ exposure to advertisements:

“We now feel that based on the engagement rates we’re seeing . . . that we’re ready to expand this further.”

Following its launch of the promoted tweets program in April of 2010, Twitter has only displayed promoted tweets to users who follow advertisers’ accounts. However, Twitter recently announced an expansion of the current promoted tweets program that will serve promoted tweets from accounts that users do not follow. In addition, Twitter recently stated that they will be moving the promoted tweets to the top of each user’s timeline. By simultaneously increasing the quantity of promoted tweets and the position of the promoted tweets within the user’s timeline, Twitter should be able to produce greater advertising revenues in the near future.

Twitter, which is projected to reach annual revenue of $200 million in 2011, recently exceeded 100 million active users. The higher advertising revenues, rapid growth, and hopes of even greater advertisement engagement rates most likely influenced the recent $8 billion valuation.

On SharesPost, a private stock exchange for non-publicly traded companies, Twitter shares opened today at a trading price that equates to a $10.7 billion market value.

[Sources Include: ZDNet, BBC News, Twitter, & SharesPost]