This month, the ACCC has published a report named the Digital Platform Services Inquiry – September 2021 Report on Market Dynamics and Consumer Choice Screens in Search Services and Web Browsers.

This comes shortly after the News Media Bargaining Code came into affect.

The report requests assistance from industry participants and ‘any other interested parties’ to ascertain views on:

“potential competition and consumer issues in the provision of web browsers and general search services to Australian consumers and in particular, the impact of default arrangements.”

It also requests views regarding choice screens.

What Is The ACCC?

The Australian Competition and Consumer Commission exists mainly to enforce the Competition and Consumer Act 2010, although it also operates with additional legislation.

Its M.O. is to promote competition and fair trading as well as regulate national infrastructure.

And it has its eye on Google.

What The ACCC Has Discovered So Far

The report revealed that Google has ‘substantial market power’ regarding the supply of general search services.

Google has held between 93-95% of the general search market share for the last twelve years.

In comparison, Bing holds 4% of the general search market share, whereas DuckDuckGo, Ecosia, and Startpage have less than 1%.

Google Pays For This Privilege

In 2019, Google was reported to be paying US$12 billion for the pleasure of being the default search engine on Apple Safari.

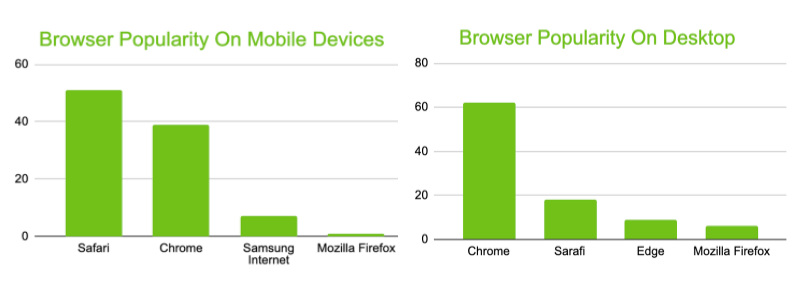

Considering that the ACCC estimates Apple Safari to be the most popular browser choice on mobile devices and the second most popular on desktop, you can see the financial incentives for Google to pay Apple such a considerable sum of money.

Google is also the default search engine on:

- Mozilla Firefox

- Chrome

- Samsung Internet

Compare Google’s 95% search engine market share to Bing’s 4%, and you get an even better picture of the power default settings have.

These findings were highlighted in the ACCC’s report.

What Is The Purpose Of The Report?

The European Commission Android Decision in 2018 and the US DOJ filing in 2020, which were both cited in the report, may best answer this question.

In 2018, the EC fined Google EU€4.34 billion for being in breach of antitrust rules:

Google both appealed this decision and committed to implementing changes such as:

Similarly, the US DOJ filed its own antitrust lawsuit in October 2020. The evidence they presented was similar to that of the European Commission:

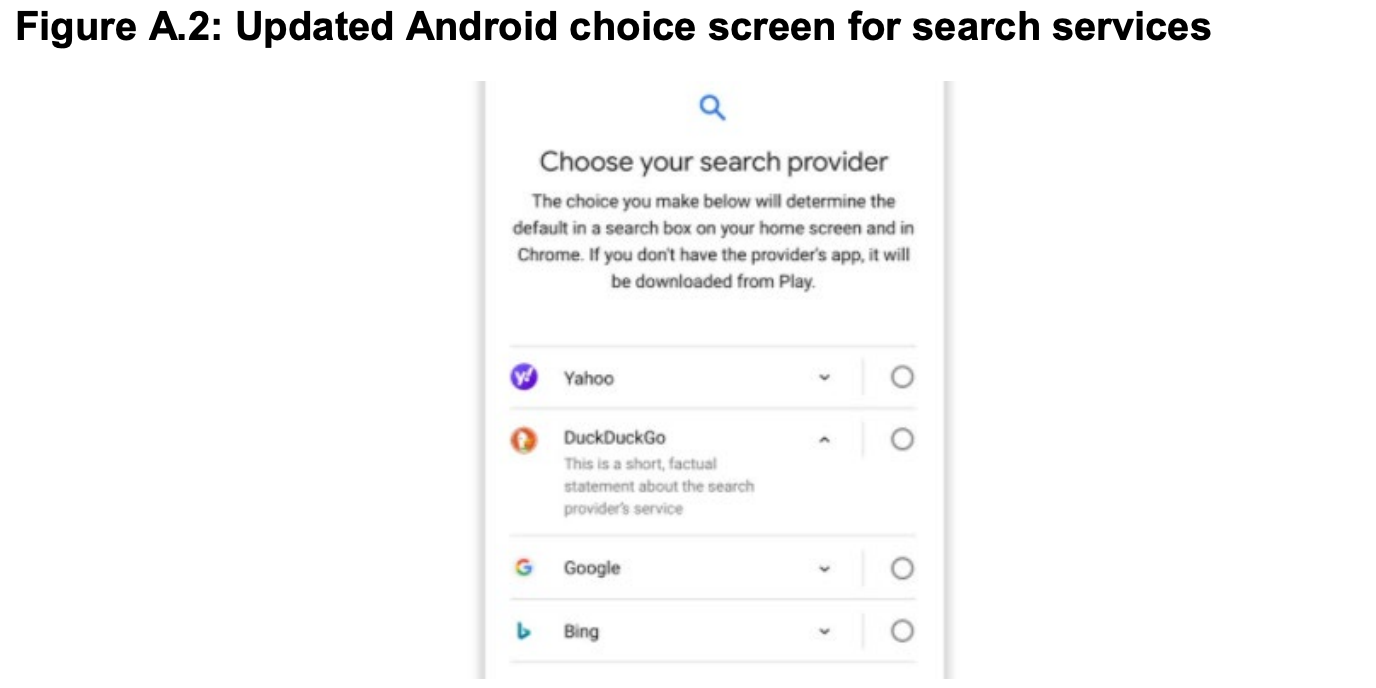

In 2019, Google announced a roll out of choice screens across Europe for new Android devices, asking Android users which search apps and browsers they want to use.

Choice screens offer users the option of four search providers, one of which is Google, and apply to search services rather than browsers.

Search engines must enter a bidding war every quarter and in every European country to be at the top of this list.

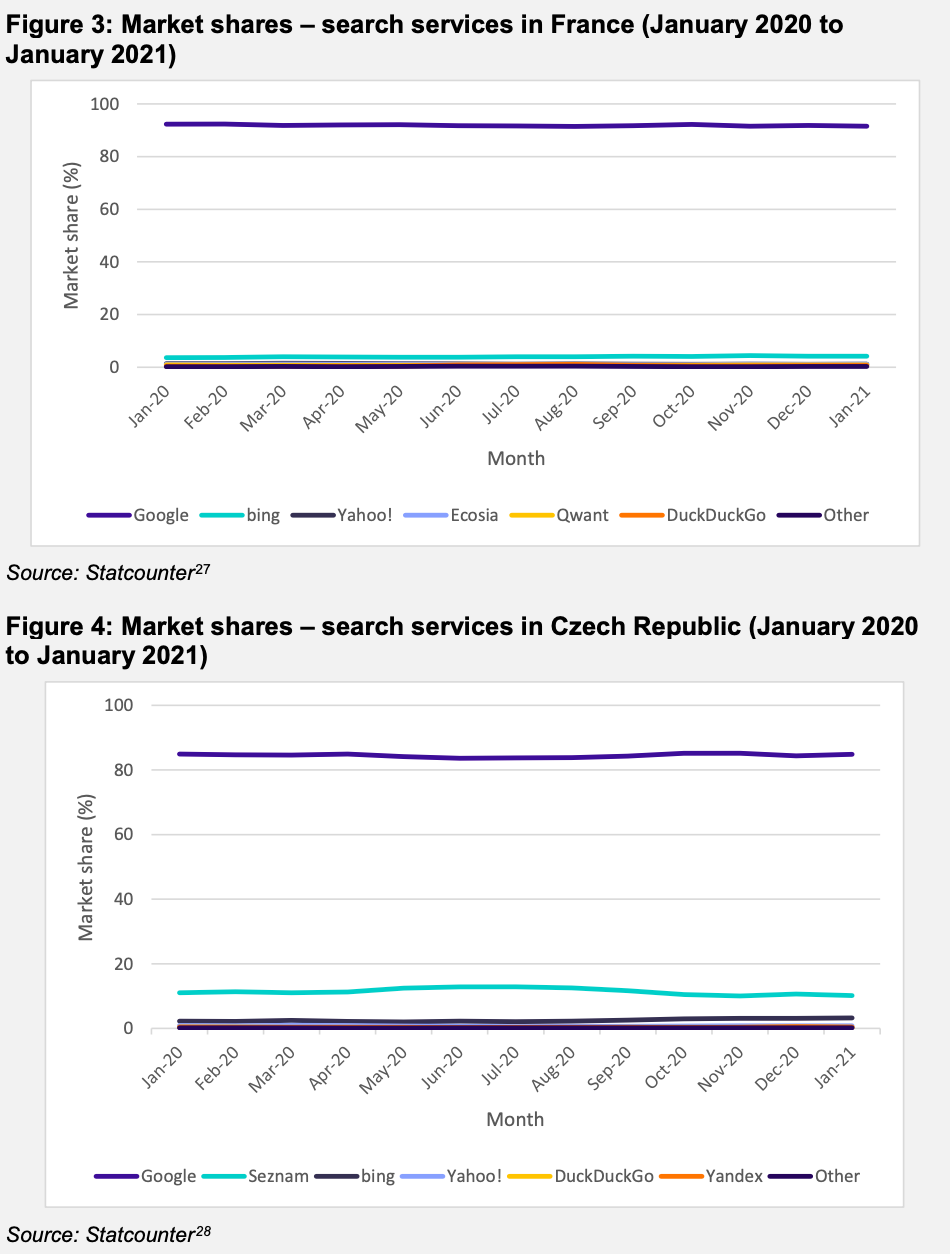

This was meant to give users more choice in their preset search preferences; however, even with this change, Google still holds the monopoly market share position, as evidenced by checks made by the ACCC in two European countries:

The ACCC report is seeking insights from participants into whether a similar choice screen roll out would be beneficial for Australia.

They are also interested in understanding:

Participants are only required to answer questions relevant to them and are also welcome to raise any points or issues not covered in the 28 questions.

What Will The Outcome Be?

Right now, the outcome of this report is unknown. Participants are requested to submit their responses by the 15th of April 2021. A report will be submitted to the Treasurer by the 30th of September 2021, and that report will then be released publicly.

What is clear is that Australia’s focus on Google is far from over.

Citation:

Screenshots and information taken from the Digital Platform Services Inquiry – September 2021 Report on Market Dynamics and Consumer Choice Screens in Search Services and Web Browsers and the ACCC website.