This morning we received news from SENSEnews announcing a revolutionary tool from the minds that brought the web hakia semantic search. Dr. Riza Berkan, one of the world’s most imminent semantic language technology gurus, and a team of co-founders, have apparently cracked a new stock market analytical methodology. Powered by hakia search technology, Berkan and his team may have just opened new avenues for market analysis – a Pandora’s Box of stock market metrics tricks.

Sense and Sensibility

SENSEnews is the brainchild of Berkan, the late imminent economist Dr. Pentti Kouri, and Prof. Onur Ozgur of the University of Montreal. The reader may recall Dr. Berkan from the so called “search engine wars” where semantic, or natural language search, threatened to upend Google’s virtual monopoly in the market.

Now Berkan’s launch of this new proprietary search/analysis tool, proves at least two things. First, Dr. Berkan and the folks at hakia have never stopped pursuing the perfect intelligent search technology. Secondly, there are far more applications of semantic technology than looking up a car dealer or YouTube video.

The details of hakia always revolved around a fantastically complicated way of indexing data. What was then termed QDEXing, or the filtering of massive data stacks by the superior methodology of Berkan & Co’s artificial intelligence, has now been applied to niche targeted practical applications. In the case of SENSEnews, using an artificial intellect to extrapolate patterns and trends etc. While this all sounds far out and complex, the end result is fairly simple – New and accurate market intelligences.

Using hakia’s semantic search technology, the SENSEnews analysis tool:

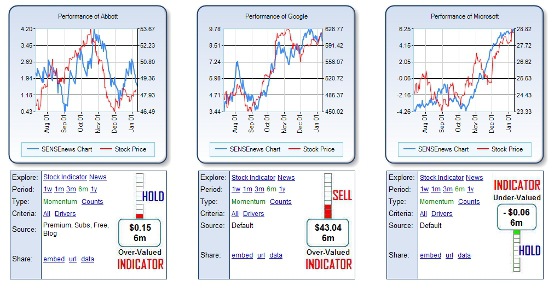

- Searches all relevant news and social media postings for a stock, basically in real time

- Calculates the stock’s implied valuation relative to its current price

- Suggests how much of that stock should be bought or sold

- Determines if the stock is a “high news risk” stock or not

- Further suggests what stocks make up the best portfolio today,

- And reveals which news items are driving its analysis (news risk) and recommendations

So Fantastic It Has To Be True

I know you are already thinking; “If this works…” Well, you supposed correctly. Dr. Berkan added this realistic note to an otherwise almost unbelievable bit of news:

“No human can track, aggregate and analyze massive amounts of emerging information continuously in the way SENSEnews does. SENSEnews empowers investors to be one step ahead in valuing equities before the market adjusts prices to that information.”

What Berkan is alluding to is this very powerful data aggregator and analysis added to the arsenal big time investors already have at their disposal. Not to “sell” Riza’s product for him, but consider a scenario where other factors indicate a stock or series of stocks will head North or South. Let’s face it, news powers the market to a large degree. With up-to-the-hour accurate trending, users of SENSEnews can “tip the decision balance” – thereby increasing their odds of being correct.

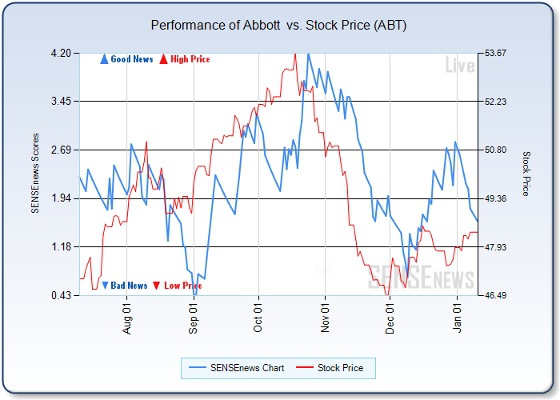

I know that sounds far out, but it is not I assure you. Imagine going to sleep knowing you put in a “buy” order that is ever so much more likely to be a wise decision. Even a shred of help along those lines is worth a great deal. And I suspect if SENSEnews can do half what this news says it can, many will take advantage of it. Just looking at the direct correlations SENSEnews indicates on their landing, it’s easy to see how this “news” based metric might work.

Never Say Never

I was first introduced to Riza Berkan 4 years ago when semantic search was all in the news every week. Many of us were deeply involved in the development of new search technologies. When the “search wars” seemingly ended once Powerset sold to Microsoft, the buzz about AI and natural language search obviously died down.

Berkan, who I always considered a friend, apparently dove headlong into the scientific rabbit hole of working out real AI, while the Powerset crew just basked in the artifificial light of MS’s Bing ever being truly semantic. At least this is my view. Bing is nothing more than a different way of organizing, Google already has as much “semantic” relevance as any, but now hakia appears to be doing something neither of the others is – applying these technologies to special cases – and in so doing, perhaps gaining significant “localized” value.

Put simply, using hakia to predict how stocks will changed based on news (and this is what it seems Berkan is up to) is like using a sledge hammer to persuade and ant (and a mighty job that could do). At least this is the potential. I for one hope hakia and Berkan have made this work. Now if someone would just front me the $183 per month it costs so I could test it.