Multiple challenges surface when creating content for a finance company.

Dealing with legalities tops the list, but there’s more. Much more.

In working with multiple companies in the financial sector and ghostwriting for top investors/financial CEOs in the pages of Forbes and other business magazines, I’ve had my share of difficulties.

Below, I share challenges marketers face when creating content for financial services brands – with a sharp focus on written content – and solutions to those challenges.

But first, let’s discuss what should guide your focus when creating content within the financial industry: Google’s YMYL and E-A-T concepts.

Understanding Google’s YMYL/E-A-T Content Guidelines For Finance

In the wake of the censorship uproar, Google took precedent to create special algorithmic considerations for information it deemed important relating to fields, such as financial advice, current events, politics, legal advice, etc.

The rationale was easy – bad financial advice leads to potentially devastating financial consequences for innocent people.

The last thing Google wants for its brand is to present bad financial information that negatively impacts your money and life.

That’s why Google refers to important content, like financial advice, as Your Money, Your Life (YMYL) content.

Google provides an explanation of how they evaluate and rank YMYL content from their report titled How Google Fights Disinformation:

“Where our algorithms detect that a user’s query relates to a ‘YMYL’ topic, we will give more weight in our ranking systems to factors like our understanding of the authoritativeness, expertise, or trustworthiness of the pages we present in response.”

With that statement said, I want you to keep in mind three relevant keywords: expertise, authoritativeness, and trustworthiness.

These characteristics would later comprise Google’s infamous E-A-T, part of Google’s algorithm and baked into Google’s Search Quality Evaluator Guidelines.

Let’s explain from a content creator’s perspective:

- Expertise: Is the specific author or publication an expert on the topic?

- Authoritativeness: How authoritative are the website and author? This depends on more traditional factors like backlinks, social signals, page traffic, etc.

- Trustworthiness: How trustworthy is the source? For example, does the source have much traffic, and has it ever received any complaints?

Unfortunately, Google’s algorithm isn’t smart enough yet to understand how viable financial advice is, so they have to consider signals such as author expertise and authority in ranking content.

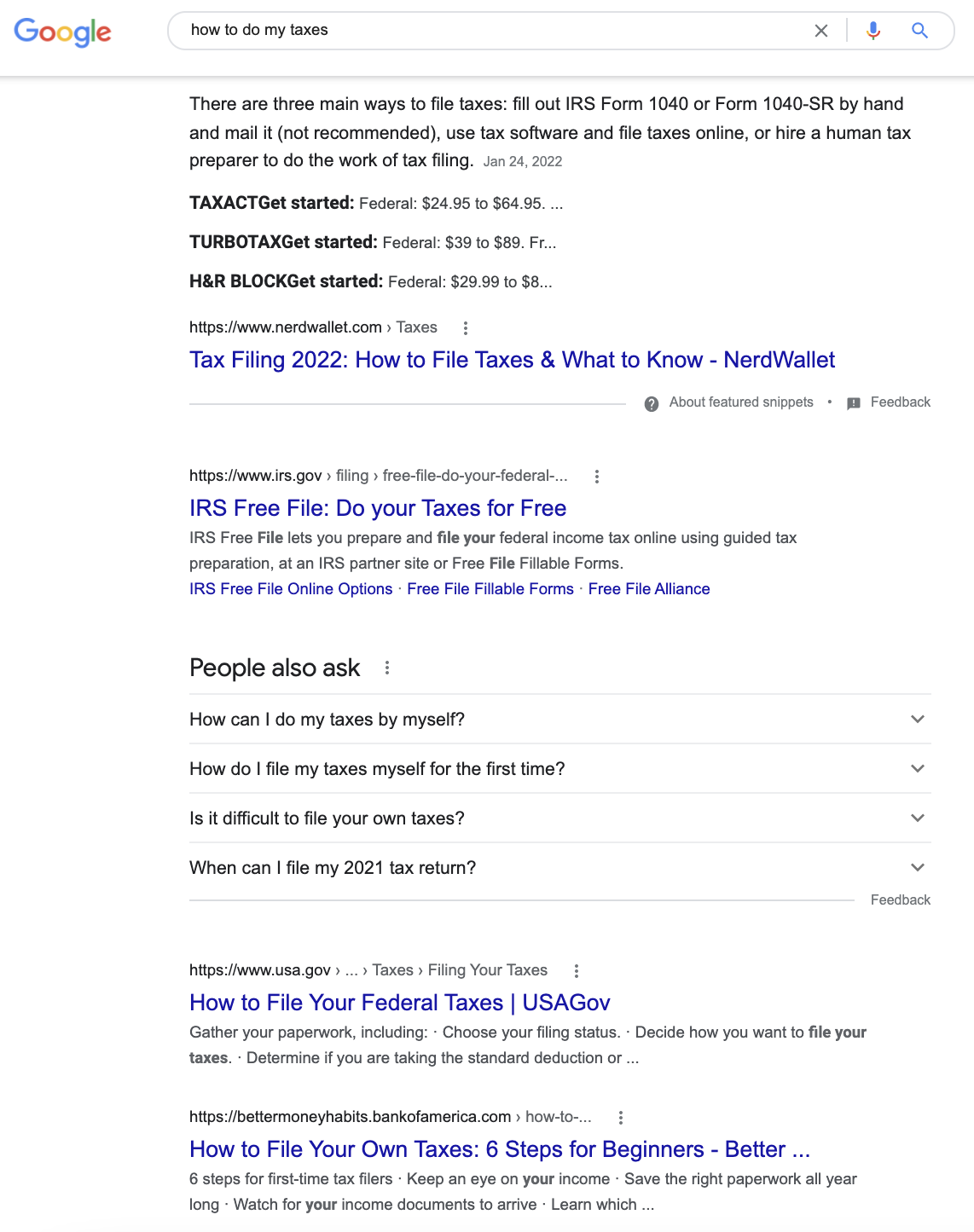

It’s why the first four results for the search [how to do my taxes] are all brands and top-level domains we recognize or trust:

Screenshot from search for [how to do my taxes], Google, February 2022

Screenshot from search for [how to do my taxes], Google, February 2022

However, this presents a significant challenge for smaller brands and businesses looking to tap into the finance sector through organic search.

In addition, there are legal and other financial concerns that arrive with financial content creation.

And it doesn’t stop there.

Implementing the strategy arrives with additional challenges that are typically more annoying than the creative thinking stage.

This is due to multiple legalities and bureaucracy behind the doors of most financial service brands.

Following are some content marketing tips for financial services brands that I’ve learned along the way.

Financial Services Content: Common Challenges & Solutions

1. Competing In Organic Search

Due to the strict measures of Google’s EAT and YMYL guidelines, a financial blog or website will never be able to compete with a Turbotax or Nerdwallet.

The most obvious solution is to generate thought leadership for their brand.

Of course, this presents a proverbial catch-22.

To build authority, you need exposure, but Google makes that very difficult for broad topics that provide the most exposure.

Here are some solutions to up our content game and present unique ideas.

Solutions

- Become a thought leader by writing guest posts for reputable blogs, writing a book or ebook related to your industry, or establishing a brand over social media.

- Target long-tail keywords for unique topics with lower search volume that is more targeted to your audience.

- Offer guest post opportunities for experts to write on your website and generate some buzz/authority.

- Create content featuring multiple financial experts to offer additional relevant information on a broader topic.

- Form partnerships with data or analytics companies for original research into trends.

- Create a survey about a broad topic to see where trends in the industry are shifting.

- Utilize video and alternative media to create shareable content on your website.

2. Complying With Regulations

Like medical businesses, false information can quickly get your client into trouble with authorities.

And of course, this will ruin your image, something that’s hard to build when you’ve been the focus of much negative criticism.

Unfortunately, financial services, especially, have some of the most intense regulatory scrutinies when it comes to producing online content, sharing it over social media, and advertising your brand.

FINRA (Financial Industry Regulatory Authority) is a well-known regulatory agency that monitors everything over social media from influencers to financial services content.

FINRA’s rules intend to “protect investors from false, misleading claims, exaggerated statements, and material omissions.”

In addition to FINRA, there are a number of additional regulations that tap into every niche of financial services content.

For example, the Office of the Comptroller of Currency has strict rules in place regulating the accuracy, clarity, and compliance of content specifically related to banking services.

Solutions

- Create disclaimers that shield your client from legal liability.

- Update their website to reflect regional privacy laws to avoid liability.

- Hire writers with knowledge of financial services.

- Set strict guidelines for content based on commonly known regulatory barriers.

- Make sure your client employs a legal review process to ensure proper compliance.

- Stick to topics you are knowledgeable about and their legal team has experience with.

3. Finding Knowledgeable Writers

In the solutions above, I outlined the need to find writers that have expertise in financial and regulatory matters.

However, as someone who’s managed a team of freelancers for years now, that’s certainly easier said than done.

The largest problem is finding those that are subject matter experts. Once you do find an expert, two other issues surface – the writer is either too expensive for your budget, or they simply can’t write well.

Solutions

- Reverse engineer E-A-T. Find writers on high-ranking SERP articles and offer them a freelance partnership (if in the budget –many of the best finance writers won’t touch articles for under $1 a word or $750 per piece!)

- Use LinkedIn to create exact ads about what you’re looking for, with examples and budget in mind. You’ll get much noise there, but you’ll find someone capable. My success rate for riders is about 10% – yes, one out of every 10 writers is typically capable of creating the content needed.

- Hire and train in-house writers.

4. Time Is Of The Essence

Financial news and current events move fast, as government and independent financial reports are generated daily.

The last thing you want is a post on a major story stuck in a week-long review. These frustrations are further amplified when working with the extended review process of enterprise companies.

If your client offers any sort of financial advice or reporting, it’s essential to optimize review processes to pump out content in real-time.

Solutions

- Set content guidelines of legal compliance with your client to reduce review times.

- Prioritize real-time and interactive content editorial review.

- Something about streamlining review with other partners (maybe taking ownership of channels or getting prior go ahead).

5. Targeting The Right Readers

You will come across a wide variety of people with different levels of expertise in the finance world.

It’s easy for readers to become inundated by jargon and complicated financial procedures, especially when dealing with topics like taxes, cryptocurrency, retirement accounts, and portfolio investing.

Simplifying content so it’s understandable by most readers is important, but so is making the optimal content for those readers most likely to go further with you or your client’s brand.

You’ll need to create a strategy that caters to people looking for general financial advice to increase your client’s authority and create targeted content for people specifically interested in employing their company.

Solutions

- Simplify top-funnel content to attract a broader audience.

- Employ a CMS to meet customers mid-funnel with targeted content based on their interaction with your site (content can be more sophisticated).

- Nurture intent by following up with relevant advice and selling points based on their engagement history.

- Feed this information to sales staff to follow up with a sales call that focuses on specific customer pain points.

6. Update Stale Content

Generally, stale content can be a waste on any site, but it could leave websites with outdated or uncompliant content in a world of legal trouble.

The solutions are simple but time-consuming.

Solutions

- Conduct a sitewide audit using a website crawler like Screaming Frog and download all URLs to a spreadsheet. After the major run, I recommend doing this bi-annually or quarterly for larger clients.

- Analyze which topics trend the most on Semrush or any tool to decipher which content needs updating or disposal.

- Delete any temporal content that is outdated or no longer complies with regulations.

- Update evergreen content with significant traffic dropoff.

7. Finding The Resources

As you know by now, financial content is complicated.

If you write on behalf of other companies or for yourself, it can be difficult to justify a budget for a single blog post that costs $750+ between research and labor.

Solutions

- Set a budget that accounts for the additional burden of writing long-form content full of financial advice.

- Set clear expectations when working with other content marketing partners about time and money.

Although the barriers to financial services and all YMYL content are higher than in other niche fields, the rewards of investing in content marketing are equally as high.

Target a blend of evergreen and trending content, and follow the advice above to speak to every target client and satisfy the tough regulations and legalities of finance content.

More resources:

- SEO For Financial Services Brands: Key Trends & Opportunities In Search

- 10 Content Marketing Trends To Watch In 2022 [Infographic]

- Content Marketing: The Ultimate Beginner’s Guide to What Works

Featured Image: eamesBot/Shutterstock

![AI Overviews: We Reverse-Engineered Them So You Don't Have To [+ What You Need To Do Next]](https://www.searchenginejournal.com/wp-content/uploads/2025/04/sidebar1x-455.png)