All eyes are on Facebook’s Q2 earnings call this coming Wednesday, in no small part because 2020 has been a tough year for the platform.

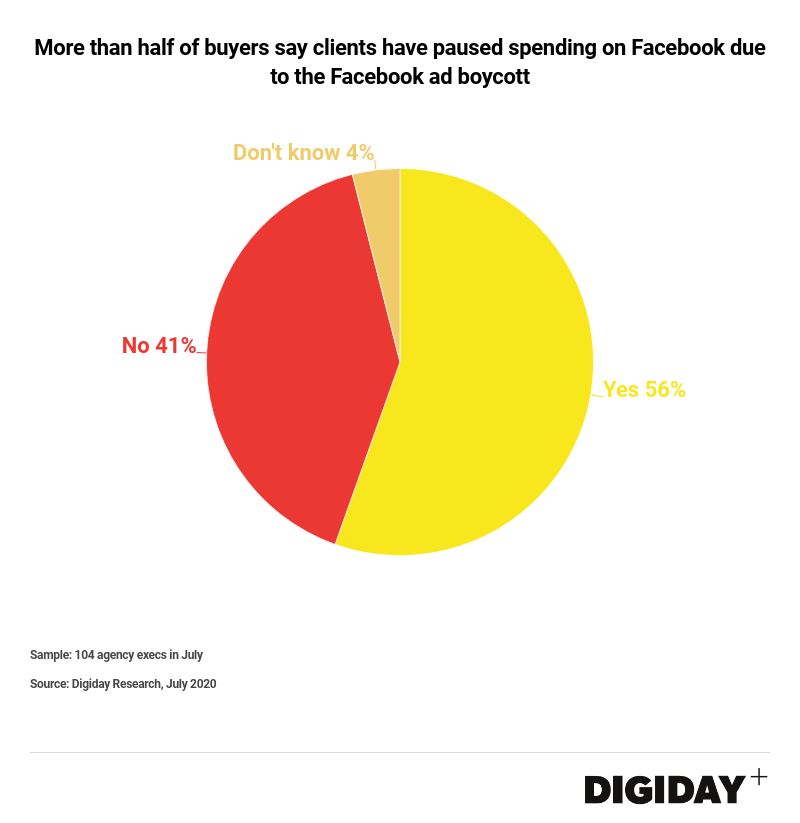

Now, a small survey conducted by Digiday reveals their Q3 earnings will probably also be equally as important. 56% of media buyers surveyed confirm their clients paused their July spending in accordance with the Stop Hate for Profit movement.

What is the Stop Hate for Profit Movement?

The movement for brands to boycott Facebook as a marketing platform was galvanized under the banner of #StopHateForProfit. The group is co-organized among several entities, including well-known social justice organizations.

Their ultimate goal has been to mobilize pressure on what are seen as lax content policies by Facebook, specifically as it pertains to things like political rhetoric, and racism.

The Stop Hate for Profit website contains an updated list of companies who have pulled spend, along with the steps it’s suggesting companies take.

What Else Has Affected Facebook in 2020?

Continuing its rocky history of public perception, Facebook has dealt itself a few more blows this year.

The decision to not curb statements made by President Trump set off a firestorm both internally and externally. Employees within the organization were highly critical of the decision, with 400 staging a walk-out at one point.

Coronavirus also created a rollercoaster in advertising revenue, with initial pandemic panic equating to low ad spend. The numbers recovered, but Covid caused other problems. Bad actors were reselling medical masks and protective gear during a nationwide shortage, and it happened during a shortage of ad reviewers on Facebook’s side. There was also a successful attempt to prove they weren’t effectively filtering out ads with Covid misinformation.

There’s been continued frustration with the upcoming election season, and what that could mean for ads and policies. This prompted recent updates by Facebook for policies, as well as users’ ability to opt out of political ads in their News Feed.

Just last week, Facebook also settled for $650m in Illinois for using facial recognition software to tags users in photos. Illinois in a consent-required state for facial recognition software, and argued that consent wasn’t obtained by users.

The CCPA also rolled out, with Facebook taking an aggressive stance to force advertisers into compliance. While the sentiment wasn’t a bad one, confusion around the policy itself and unprepared media buyers created a bad start to July.

After over a year of stressing that their Campaign Budget Optimization feature would be a requirement, they threw in the towel, and opted not to enforce it.

Is the Ad Revenue Pause Tied to the Economy?

It’s been questionable how much spend pausing has to do with the current economic climate, versus a social statement.

However, a little less than half surveyed said their clients would spend more if Facebook’s reputation and values better-aligned with theirs.

When asked how long they expect the pause to last:

- 41% said spending will resume by end of July

- 26% said it won’t be until the end of Q3

- 17% said it won’t be until Facebook makes “meaningful changes”

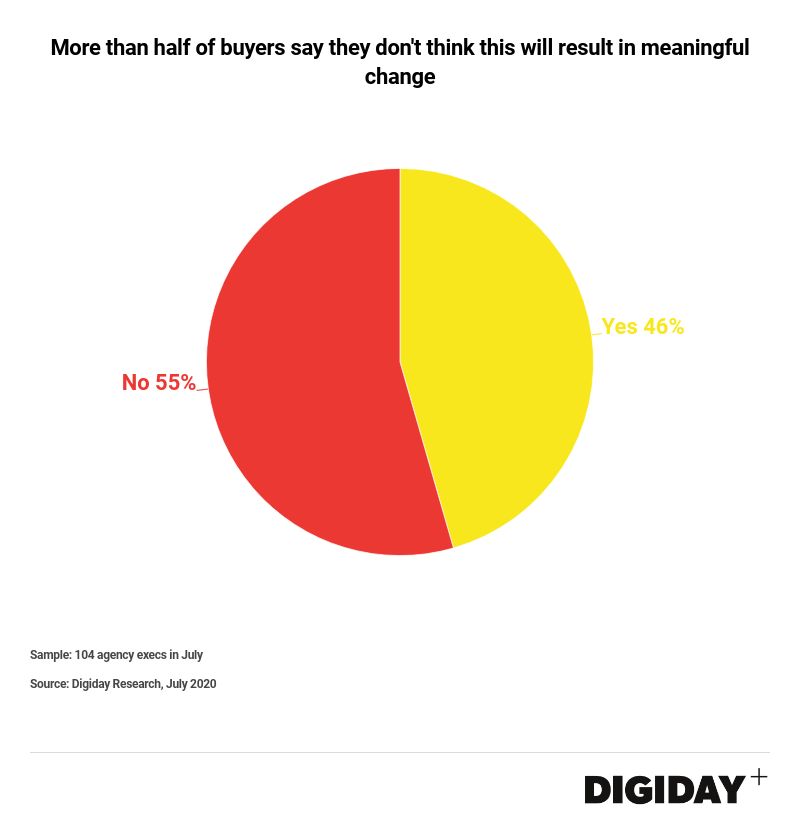

While “meaningful changes” aren’t defined, buyers said giving them more control and removing hate speech are the two most important things they could do at this point.

Despite these sentiments, buyers are split on whether this boycott will actually accomplish anything

The Q2 earnings call this week will only cover the beginning of boycott discussion, which heated up in May and June.

The full effects of it on Facebook’s bottom line won’t be known until Q3 closes out, but all eyes are on Q2 results to be a leading indicator of what will be seen at that point.

![[SEO, PPC & Attribution] Unlocking The Power Of Offline Marketing In A Digital World](https://www.searchenginejournal.com/wp-content/uploads/2025/03/sidebar1x-534.png)