Boost your skills with Growth Memo’s weekly expert insights. Subscribe for free!

The voices criticizing Google for killing small sites are shouting louder.

Cases like HouseFresh or Retro Dodo garnered a lot of attention and made compelling cases. Hardcore updates and the growing rift between SEOs, publishers, and Google add kerosene to the fire.

The most volatile market in the world is not Brazil, Russia, or China. It’s Google search. No platform has as many changes of requirements. Over the last 3 years, Google launched 8 Core, 19 major and 75-150 minor updates. The company mentions thousands of improvements every year.

The common argumentation is that Google is breaking apart under the weight of the web’s commercialization. Or Google is cutting off middlemen like affiliates and publishers and sending traffic directly to software vendors and ecommerce brands.

But does the data support those claims?

As the saying goes, “In God we trust, all others must bring data.”

Does Google Give Big Sites An Unfair SEO Advantage?

I thoroughly analyzed sites that lost and gained the most SEO traffic over the last 12 months to answer the question of whether big sites get an unfair SEO advantage.

TL;DR: Google does indeed seem to grow large sites faster, but likely due to secondary factors instead of the amount of traffic they get.

Method

- I pulled the top 1,000 sites that gained and lost the most visibility over the last 12 months, each from Sistrix. I picked relative change over absolute to normalize for size of the site. For the list of winner sites, I set a minimum SEO visibility of one to filter out spam and noise.

- Then, I cross-referenced the sites with backlinks and traffic data from Ahrefs to run correlations against factors like site traffic or backlinks.

Results

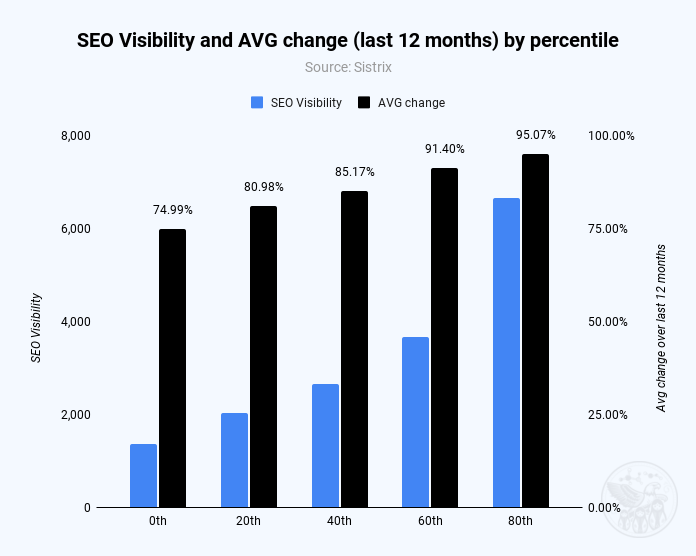

Sites in higher visibility percentiles have a strong relationship with SEO visibility growth over the last 12 months.

Sites that lost visibility have no relationship between the size of their loss and SEO visibility. We can, therefore, say bigger sites are more likely to be successful in SEO.

However, let’s not forget one thing: Newcomer sites can still get big. It’s harder than it was five or ten years ago, but it’s possible.

There are two reasons why big sites tend to gain more organic traffic.

One reason is how Google weighs ranking signals. Bigger sites tend to have more authority, which allows them to rank for more terms and grow their visibility if they’re able to avoid scale issues, keep content quality high, and continue to satisfy users by solving their problems.

Authority, based on our understanding, is the result of backlinks, content quality, and brand strength.

Google seems to be aware and taking action.

The correlation between SEO visibility and the number of linking domains is strong but was higher in May 2023 (.81) than in May 2024 (0.62). Sites that lost organic traffic showed lower correlations (0.39 in May 2023 and 0.41 in May 2024).

Even though sites that gained organic visibility have more backlinks, the signal seems to have come down significantly over the last 12 months. Backlink volume is still important, but its impact is shrinking. Mind you, volume and quality are two different pairs of sneakers.

The second reason big sites are gaining more organic traffic is Google’s Hidden Gem update, which gives preferential treatment to online communities. The impact is quite visible in the data.

High at the top of the winner list, you find online communities like:

- Reddit.

- Quora.

- Steam Community.

- Stack Exchange.

- Ask Ubuntu.

Anecdotally, I noticed strong growth in popular SaaS vendor communities like HubSpot, Shopify, and Zapier. Surely, there are online communities that don’t have the same visibility as the big ones, but still grew significantly over the last 12 months.

The list of losers concentrates on publishers and ecommerce. A surprising number of big publishers lost organic traffic from classic blue links, equal to smaller publishers.

Examples of big publishers:

- nypost.com (-62.3%).

- bbc.com (-58.6%).

- nytimes.com (-40.3%).

- cnn.com (-40.1%).

- theguardian.co.uk (-32.8%).

Examples of small publishers:

- makeuseof.com (-79%).

- everydayhealth.com (-70.6%).

- thespruce.com (-58.5%).

- goodhousekeeping.com (-46.5%).

- verywellfamily.com (-38.4%).

Keep in mind that publishers rely a lot more on traffic from Top Stories, Google News, and Google Discover, which are not reflected in the data.

Popular Parasite SEO targets like chron.com or timesofindia.com lost significant SEO traffic, as did sites that are not on the list, like medium.com or linkedin.com/pulse. How much effort Google puts into cleaning the search engine results pages (SERPs) is unclear.

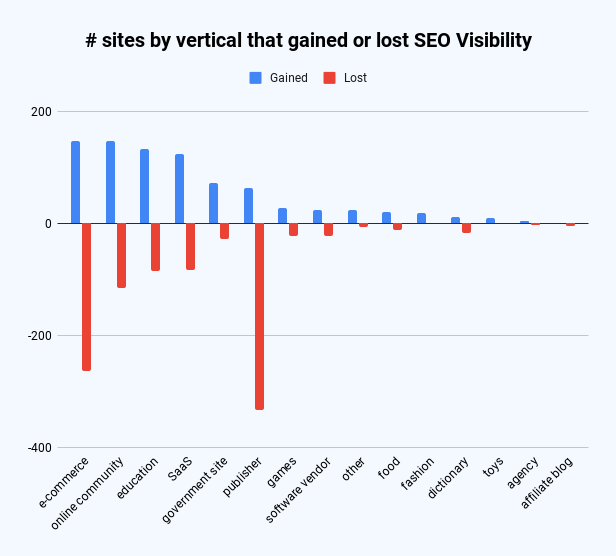

Two-thirds of sites on the list of winners were either SaaS companies, ecommerce companies, education companies, or online communities, with gains between 63% and 83%.

Over 50% of sites on the loser list were publishers or ecommerce sites, with losses between -45% and -53% SEO visibility.

It’s a lot harder to succeed in ecommerce and publisher SEO as almost twice as many ecommerce and five times as many publishers lost SEO visibility than gained.

The top 5 loser sites with the highest SEO visibility in May 2023 are:

- target.com (-35.5%).

- wiktionary.org (-61.5%).

- etsy.com (-43.6%).

- nytimes.com (-40.3%).

- thesaurus.com (-59.7%).

I found no discernible pattern for country code top-level domains (ccTLDs): 75% of sites on the winner list had .com ccTLDs. Only 65 were .edu, 39 were .gov, and 94 were .org.

Limitations

- Of course, the biggest limitation of the analysis is that sites could have gained or lost traffic due to SEO campaigns, technical issues, or domain migrations.

- The second limitation is the small sample set of 2,000 sites. Even though the analysis looks at the peak of the iceberg, the web might hold millions of sites.

Open Questions

There is a lot of room for interpretation when we talk about the word “big” in big sites. Are we talking about a certain amount of traffic, being owned by a big company, or making a lot of money when calling a big site big?

I focused on organic traffic in this analysis, but it would be interesting to see how some of the biggest companies fare in SEO. One reference point could be Glen Allsopp’s analysis of the big publishing houses dominating the SERPs.

Another question is when Google rewards big sites. During algorithm updates? Continuously over time? An answer would help us understand better how Google works.

I’ll leave you with this: In my interpretation of the data, what made big sites successful is often what keeps their growth going. When a site figures out the right quality for content or a good user experience, it’s more likely to grow continuously than sites that have plateaued or declined in traffic.

Personally, I doubt that people at Google deliberately decide to “go after a niche” or “kill small sites,” but rather that algorithmic decisions lead to those outcomes.

That is not to say Google doesn’t carry a certain responsibility.

Featured Image: Paulo Bobita/Search Engine Journal