The second-hand ecommerce sector is significant.

The market for global resale apparel alone reached $227 billion in 2024 and is projected to hit $367 billion by 2029.

This once traditional way of shopping in thrift stores and auction houses has changed drastically. U.S. online resale is expected to nearly double by 2029, reaching $40 billion.

What’s referred to as the “second-hand economy” represents a shift in how people shop, their adaptability to economic changes, and a way of acting on growing sustainability concerns by buying pre-loved items.

As this market expands at pace, brands are ramping up their investment in paid search, with major players like eBay spending over $150 million per year on Google Ads alone.

With this growth in PPC spending, brands are looking to scale and scale fast.

However, running PPC for second-hand or resale ecommerce is a very different ballgame from a traditional ecommerce model, where brands are either manufacturing the items they sell or reselling new items.

In this post, I’ve shared five ecommerce PPC strategies for second-hand retailers that will help find success.

Before we jump into them, let’s dig into a few key challenges that are unique to managing paid search in this market.

Key Challenges Unique To PPC For Second-Hand Retailers

Inventory Turnover And One-Of-A-Kind Products

The flow of products will vary by retailer.

Take eBay, for example. It likely has hundreds (even thousands) of certain items, but for smaller retailers or specialised brands (such as antique or vintage resellers), it is most likely dealing with one-of-a-kind products.

In this scenario, once a product is gone, it’s gone.

Bidding algorithms get little time to learn which products convert the best, as many items may only be in the feed briefly, whereas others may remain in the product feed for a long time and be deprioritized by newer items.

Frequent Product Updates & Data Quality

For some second-hand retailers, inventory can change daily (or hourly) as new products are acquired and are listed on the site to sell through as soon as possible.

This movement, whether fast or slow, impacts both PPC campaigns that use product feeds (such as Google Shopping or Performance Max) as new data is fed into the campaigns on a frequent basis.

It can also impact search campaigns as products move in and out of stock.

Let’s say a brand has a search campaign bidding on keywords themed around “second-hand Herman Miller chairs.” It sells through 80% of the stock and is waiting for new SKUs to be added.

The efficiency of the campaign will decline, and spend could be wasted. This isn’t just for second-hand retailers; it also applies to all PPC ecommerce strategies.

In addition, data quality has to be bulletproof to ensure that products are entered into the most relevant auctions and searchers are provided with the best possible data prior to clicking through.

For example, say one product is uploaded with the title: Nike – Air Force 1 ’07 – White – Size 10. And another: Carhartt Hoodie.

In this scenario, retailers will be forever going back and forth across various teams to fix data issues with the feed (something I’ve seen firsthand).

Then, throw in brands such as Depop and Vinted, which have user-generated listings, and the task of creating a refined, rich data feed becomes even more complex.

Dynamic Budget Allocation

With an ever-changing flow of products and search queries, accurately forecasting and allocating budgets can be a difficult task.

A category may perform great one month, where SKUs that are in high demand are in stock, then drop off the following month as the conversion rate declines due to a less desirable product selection.

Dynamic budget allocation is essential, as there are so many moving parts.

Advertisers must monitor stock levels across many touchpoints (e.g., brand, category, material) and trends in search queries, and undertake systematic performance reviews to feed into how much budget to cut out for PPC and where to allocate this.

Complex Measurement And Reporting

With SKUs coming and going, traditional product reporting is limited.

Advertisers can’t rely on item-level metrics alone, as many items have zero sales (or a single sale) before being removed from the feed and out of product/listing groups.

This essentially takes away the traditional strategy of catering to your “best sellers” first – a strategy that relies on accrued product-level data to feed into various characteristics set by advertisers (e.g., X number of sales over X days at a ROAS of X = best seller).

Second-hand retailers must aggregate their product data to uncover trends in brands, styles, materials, product types, and more.

This comes with a level of expertise in creating these reports and the time to maintain, update, and actually use them to inform the PPC strategy.

So, How Can Second-Hand Retailers Succeed In Paid Search Given The Limitations?

Despite these challenges, second-hand retailers can thrive with PPC.

Here are five strategies that are tried and tested and will lay the groundwork for creating a second-hand PPC powerhouse.

1. Optimize And Enrich Your Shopping Feed

Product feeds are the heart of PPC for ecommerce.

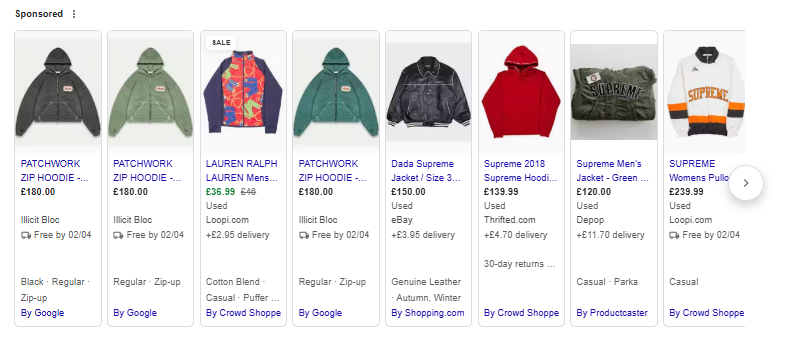

Campaign types that use product listings, such as Google Shopping and Performance Max, allow advertisers to get their products in front of searchers prior to clicking through.

Screenshot from search for [second hand supreme jackets], Google, March 2025

Screenshot from search for [second hand supreme jackets], Google, March 2025So that you can sleep at night knowing you’re matching the most relevant queries and ensure you have the best possible data in your feed, I’d recommend this approach:

- The Basics: Create a structure and put a process in place that accounts for every stakeholder who will be involved in feeding data at any point. If you want to ensure you spot any anomalies immediately (definitely recommended), you could use a third-party tool, export your feed to a sheet, and build a script to check that all SKUs follow the same pattern.

- The Next Step: Custom labels, keyword research, supplemental feeds, and more. This could be:

- Adding detailed information on the condition of an item in the description, with a summary in the title (e.g., new with tags, used once, X number of owners, etc.).

- Qualifying that the items are not brand new. This will help with both entering into ad auctions for pre-loved/second-hand queries. It will also help qualify traffic as your listing will clearly show up front that it is not new.

- Categorizing groupings such as era, designer, or material for antique and vintage stores. This is useful for structuring both the feed and the way campaigns are grouped in the ad platform.

2. Think Categories (Or Bespoke Groupings), Not Individual Product Sales

Ecommerce PPC strategies are often built on best-selling product data.

This segment naturally demands the highest budget allocation as conversion rate, return on ad spend (ROAS), etc., is often the highest.

However, many second-hand retailers may only ever have one (or a handful) of every item, which almost breaks apart the traditional approach of managing paid search for ecommerce.

All is not lost, though. Brands can find success by segmenting (and reporting) by category and using this to steer budgeting, forecasting, day-to-day optimisation, and more.

Aggregating this data helps to:

- Uncover meaningful trends to both share with the wider business and feed into bidding algorithms.

- Set the foundations for adapting to change. For example, say a luxury handbag reseller receives a high intake of products from a new brand/designer. A category-level split will help facilitate driving visibility for these items through PPC, whereas if a “best-seller” structure were used, it would not contain the new items and wouldn’t prioritize them.

- Assist with flexing media budgets, as depending on size, some retailers may be dealing with hundreds of thousands of items and being able to pull back and scale spend on what works is crucial.

3. Don’t Be Afraid To Broaden Your Reach, With Care

I have seen many brands in this space doubling down on Search and Shopping, with strict query funneling to only serve ads for queries that contain “second-hand”/”pre-loved”/”used.”

This is logical and may work well. However, for this theoretical example where we don’t have data, this strategy neglects multiple audiences who are not only in the market for the items, but may convert higher for the short term and help drive up Customer Lifetime Value (CLV) in the long run.

This strategy makes the assumption that if the query has been pre-qualified (second-hand/pre-loved/used, etc.), the audience searching will be the most profitable, which, in my experience, is not always the case.

Take a second-hand camera retailer, for example. If it only bids on pre-qualified queries such as “used Canon cameras” or “second-hand point-and-shoot cameras,” it would miss all users who are looking for the brands they sell, general camera queries, longer-tail searches, and more.

This is where campaign types such as Performance Max and especially Dynamic Search Ads (DSA) are certainly worth testing to expand your reach and serve ads for intent-driven searches across a wide range of audiences.

4. Align PPC Efforts With Inventory And Operations

This isn’t exclusive to second-hand retailers, but it is especially important.

Cross-team collaboration is a must when products are flowing in and out of stock, and retailers have an ever-changing number of products on site.

Data should flow both ways:

PPC → Wider Team (Merchandising, Buying, Operations, etc.)

- Which categories/brands/designers have indexed up or down vs. average over a certain time period?

- Are there any new queries that can help with product acquisition?

- How has category X trended over time since stock volume increased considerably?

Wider Team → PPC

- We’ve got X units of brand A and more to come over the next three months. How do we prioritize this?

- The stock of category X has begun drying up. There’s not much on the market, so a restock is unlikely soon.

- Returns for brand X are 50% above average. How much are we spending on these items each month?

Creating a virtuous cycle will only improve PPC performance and build relationships.

Finding the best way to pull this data may take time, as teams will need to share various datasets (stock reports, CRM, order books, etc.) to then feed into a centralized report, but the payoff is definitely worth it.

5. Think Outside Of The PPC Box

In the world of second-hand retail, the importance of PPC teams having a clear understanding of profitability outside of account-level KPIs such as ROAS or cost per acquisition (CPA) is crucial.

Unlike a traditional ecommerce model where brands manufacture the products themselves, the second-hand market, whatever the product may be, will likely make less margin comparatively due to lower prices, costs of acquiring the product, operational expenses, etc.

Here are a few metrics I would highly recommend keeping close to when making strategic PPC decisions:

- Return Rate: The average return rate for ecommerce was 16.9% in 2024, with products that require specific fits (clothing, shoes, etc.) rising as high as 30%, and even further during peak. With margin front of mind, weaving these rates into PPC budgeting, forecasting, and setting KPI is essential.

- New Customer Acquisition Cost (nCAC): This measures the average expense incurred to acquire a new customer and is calculated by total new customer marketing expenses/number of new customers acquired. While it may not be the primary goal, nor are all accounts built to accommodate clear, new, and returning budget splits, this is a metric that must be observed in line with CLV, ROAS, etc.

- Customer Lifetime Value (CLV): PPC teams operating within this business model have to look past the first sale. CLV helps quantify the long-term value of a customer, which unlocks more informed decisions for budgeting, forecasting, and optimization, especially when acquiring new customers.

In second-hand retail, where margins are tighter, understanding the full customer journey and setting KPIs using a clear view of profitability will empower PPC teams to make smarter, more commercially aligned decisions.

Summary: A Different Approach, A World Of Potential

With changing inventory and tighter margins, advertisers need to adopt a different approach to PPC.

Whether a billion-dollar resale store with self-serving listings or a small clothing store, the same principles apply. As with most things PPC, it all comes back to having clear, accurate data.

Advertisers have a wealth of tactics to consider, from ensuring the feed is the best it can be to setting targets using bespoke groupings that change over time.

One-size-fits-all approaches may bring short-term stability, but for long-term growth and scalability, the teams that think and adapt quickly will lead the pack.

More Resources:

- How To Consider The 4 Ps Of Marketing In Ecommerce & Paid Media

- How Proper PPC Management Can Save You Money

- PPC Trends 2025

Featured Image: Wayhome Studio/Shutterstock

![[SEO, PPC & Attribution] Unlocking The Power Of Offline Marketing In A Digital World](https://www.searchenginejournal.com/wp-content/uploads/2025/03/sidebar1x-534.png)