To help diverse businesses and address cash flow needs, Facebook is introducing ways to access funding and get connected with business resources and networking groups.

Many small businesses are still struggling financially. According to a report from Facebook, 60% of SMBs say they they had difficulty paying business-related expenses, and roughly a quarter reported struggling to pay down loans or debt, bills, rent, and employee wages.

Facebook is announcing new programs and tools to assist businesses with overcoming these challenges. They include:

- Facebook invoice fast track program

- A new small business funding resource

Here’s more about how businesses can benefit from these new resources.

New Resources For SMBs on Facebook

Facebook Invoice Fast Track Program

Instead of waiting the 60 to 120 day period it normally takes to get paid, the Facebook Invoice Fast Track Program will help get businesses paid faster.

Beginning October 1, eligible US-based small businesses will have the opportunity to get cash immediately for the goods and services they’ve invoiced their customers.

The program’s landing page describes how the process works:

- Upload invoices

- Pay 1% of the invoice value in fees

- Receive payment

After the business receives payment from Facebook, the client then has to deal with Facebook directly:

“We’ll notify your customers that they’ll pay the Facebook Invoice Fast Track program when the invoices reach term. When they pay us, we’ll use 100% of that money to help more businesses like yours.”

Who is eligible?

There are a few restrictions to this program. For one, the recipient must qualify as a diverse business:

“This program will be available to U.S. for-profit companies that are certified as majority-owned, operated and controlled by racial or ethnic minorities, women, U.S. military veterans, LGBTQ+ people or individuals with disabilities.”

Other restrictions include:

- The invoices must have a minimum value of $1,000 and be submitted to a client for payment.

- The client must have an investment-grade rating.

- In most cases, participating businesses must sell all eligible invoices they have with those clients.

Facebook also covers itself by saying “not all submitted invoices will be funded.”

Be aware that your mileage may vary with this program, as Facebook is not obligated to pay all invoices. But it is an option to explore if you need it.

Facebook is committed to funding $100 million in invoices on an ongoing basis. The nationwide rollout of this program follows a successful pilot test. Registration opens on October 1.

Small Business Funding

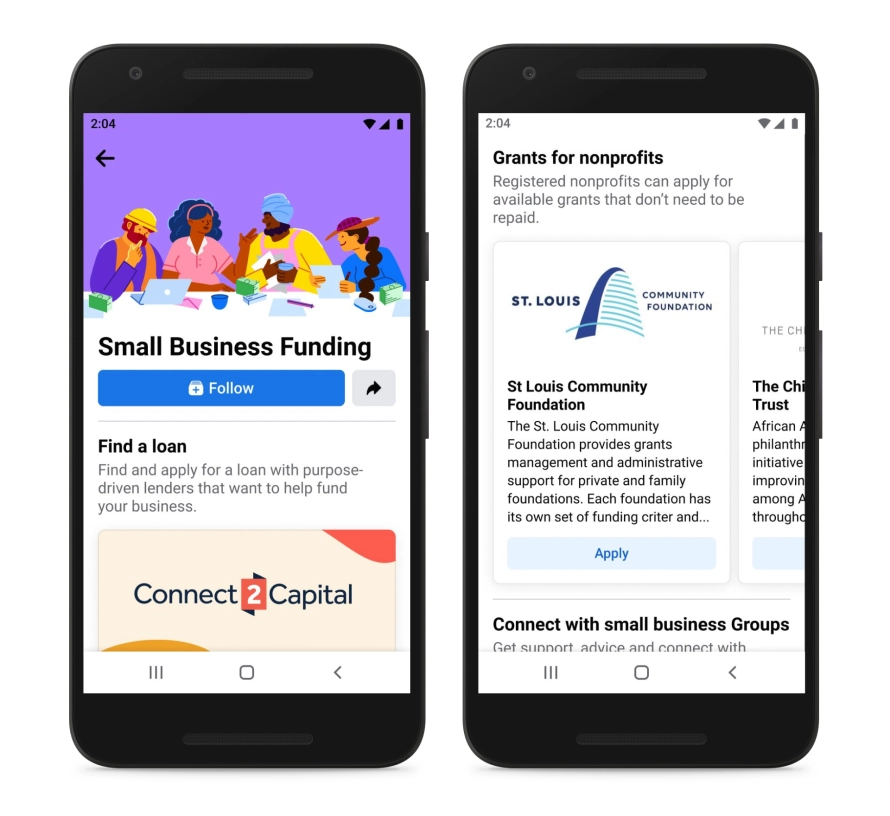

Facebook is rolling out a new hub to connect business owners with purpose-driven grant & loan opportunities.

You can find and apply for loans directly in the small business funding hub. Registered nonprofits can apply for available grants that don’t need to be repaid.

More Resources On the Way

Lastly, Facebook is announcing the second year of its global holiday program called The Boost with Facebook Good Ideas Season.

Starting in October, businesses can access free resources, digital skills training, thought leadership, and networking opportunities.

Source: Facebook Newsroom

Featured Image: DollarWoman/Shutterstock

![AI Overviews: We Reverse-Engineered Them So You Don't Have To [+ What You Need To Do Next]](https://www.searchenginejournal.com/wp-content/uploads/2025/04/sidebar1x-455.png)