Although Facebook co-founder and CEO Mark Zuckerberg has repeatedly stated that he is opposed to rushing the company to an initial public offering (IPO), there are new rumors that an early 2012 offering is likely and even a December IPO is possible. While a December IPO is highly unlikely due to regulatory requirements and filings, there is internal pressure to bring the social media company to the markets in the near future.

Earlier this year Zuckerberg stated that Facebook was expected to pass 500 shareholders and as a result would be required to file public financial reports by the end of April 2012. However, recent reports are suggesting the primary motivator for Facebook’s IPO is not regulatory requirements. Instead, it seems that the motivation for the IPO is to allow Facebook’s employees to sell their stock, which is currently restricted. Restricted stock units (RSUs), which Facebook switched to in 2007, can only be sold after an IPO takes place. Since Facebook’s valuation has increased exponentially over the past few years, many employees want to cash out and instead are being forced to hold their RSUs until the IPO.

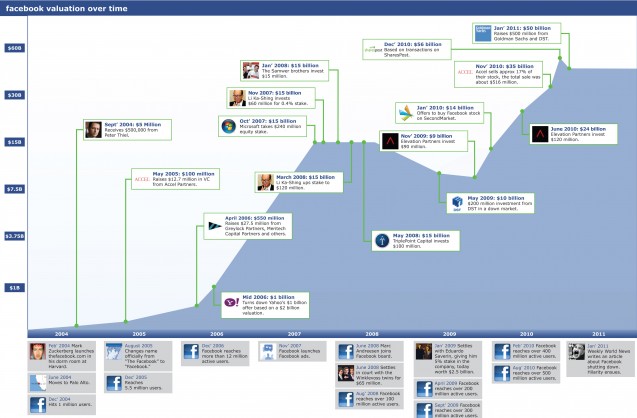

When Facebook goes public, the valuation and offering price will be extremely difficult to set. Between 2007 and 2009, Facebook received several investments that valued the company between $10 billion and $15 billion. In December of 2010, Facebook raised $1.5 billion after receiving a Goldman Sachs valuation of $50 billion. Since the Goldman Sachs valuation last year, the secondary markets for Facebook stock have been volatile, but steadily increasing and currently are trading at a price that equates to approximately an $80 billion market value.

In recent months, LinkedIn, Groupon, and Angies List have tested the markets with IPOs and have been pleased with the way the market treated their stock. In addition to Facebook’s likely IPO, Yelp announced last Thursday that they are planning on going public in early 2012.

[Sources Include: TechCrunch & Business Insider; Infographic by TechCrunch]

![Facebook IPO: Public Offering in Near Future? [INFOGRAPHIC]](https://www.searchenginejournal.com/wp-content/uploads/2011/11/facebook-valuation-infographic.jpg)