It’s no secret that the grind of startup culture can be difficult for many young entrepreneurs to overcome.

Perhaps the biggest challenge for any entrepreneur within the startup world is acquiring financing for your project.

While it may seem more costly to purchase an existing business, it can be more financially advantageous and help you escape debt quicker.

Additionally, purchasing an existing business is a great way for people to get involved in entrepreneurship without the stress of creating a unique or creative idea.

Like buying a franchise, many online businesses are turnkey and allow you to assume operations without making large changes.

With the explosion of ecommerce sales totaling over $5 trillion in retail in 2021, one area I recommend many new entrepreneurs turn to is online businesses.

There are millions of websites, apps, and software programs you can find for little cost and make incredibly profitable with minimal effort.

To help entrepreneurs get started, here’s an outline of the benefits of purchasing an online business and various avenues to find the best deal.

The Benefits Of Purchasing An Existing Online Business

Did you know that 18% of businesses fail in the first year, and almost half of all businesses fail within five years?

Unfortunately, startups are very risky endeavors, which is why many investors are reluctant to finance startups from young entrepreneurs.

While online businesses have the flexibility to reduce some of the risk and costs of overhead associated with a brick-and-mortar store, no startup is entirely risk-proof.

For this reason, purchasing an existing and successful online business can significantly reduce your risk, help you capitalize on your investment immediately, and get your feet wet in entrepreneurship.

The benefits of purchasing an existing online business include:

- Reduced risk: Purchasing an established business with a proven business model takes much of the risk and guesswork out of your business plan. While no business is free from risk, you can rest assured that an established pathway to profitability is open to you if you choose to follow it.

- Increased flexibility: One reason I prefer an online business is the flexibility you get from operating over the web. You can establish your business anywhere, work from anywhere, and hire anyone with access to a computer and the internet.

- Global reach: Online businesses are not restricted by location and can market to people worldwide using online advertisements and traditional SEO strategies.

- Steady revenue: One of the biggest challenges of any business is getting out of the red and overcoming initial debt to become profitable. Fortunately, buying an established business allows you to tap into an existing revenue stream in exchange for a large upfront sum. Of course, some may not have strong or zero revenue, but at least you’ll have some data to improve things.

- Established brand: Another way established businesses reduce risk is by giving you access to an established customer base and branding strategy. You can save time on market research and tap into proven marketing/branding strategies that yield positive results.

- Turnkey team: Not only does an established team reduce the need to build a team from scratch, but the team you inherit should already be familiar with your business model and the products/services you’re selling.

- Proven products/services: Established businesses have the luxury of tapping into existing products that provide value for your customers. While some iterations may be in store, you can greatly save time on market research and expensive product development and testing processes that slow down business development.

- Existing supplier relationships: Finally, having established supplier relationships in today’s global environment is a luxury that cannot be ignored. Between consistent supply chain issues, having an established supplier for all of your business needs can help you get off the ground quickly.

Most Profitable Types Of Online Businesses

After understanding the benefits of buying an online business, the question becomes: what kind of business do you want to purchase?

While this choice comes down to your personal preference, I’ve outlined a list of the most profitable and popular online businesses that anyone can get into.

- Selling domain names.

- Ecommerce stores.

- Online blogs.

- SaaS companies.

- Mobile app and web developers.

- Dropshipping companies/reseller marketplaces.

- Affiliate partners.

- Digital service providers.

- Network security operators.

- Virtual training/education platforms.

- Blockchain-operated businesses.

- Virtual assistants.

- Survey providers.

How To Buy An Online Business: 3 Approaches

Unlike a brick-and-mortar store with a big “For Sale” sign hanging from its window, you might not know where to start looking for online businesses.

Generally, there are three different approaches to finding and purchasing an online business or store.

Direct Purchase

The most straightforward way to purchase an online store is by contacting a store owner directly and making a direct purchase. However, finding an online business directly may be more difficult.

You can use social media, including LinkedIn, to find any business owners who have listed their websites for sale.

Another option may be to contact a site owner of a business you like directly using the contact information listed on their website or this site to see if they are willing to sell their business or website to you.

Online Exchange

Another way to purchase an online business directly is by finding a company for sale over an online exchange.

Exchanges offer you valuable financial and contact information and listing prices so you can make a bid.

These exchanges provide a safe place to buy and sell an online business, though some may be configured as an auction. A few are listed later in this article.

Online Broker

Finally, if you don’t have the time or knowledge to determine what online business is right for your portfolio, you can hire an online broker.

These brokers offer the same services as in the financial industry or real estate, offering due diligence to make the best decision for your bottom line.

You can find brokers using many of the same platforms I list below to shop for individual listings.

Brokers will come with their fees, but they can ensure you find a business that is profitable and right for your financial well-being.

How To Assess An Online Business Purchase

Some business investments are better than others. To ensure you get the best deal for your purchase, I’ve outlined a few considerations to help you evaluate a potential business for sale.

- Business model: Analyze your target business’s revenue model and its profitability. What income streams does this business have, and are they steady for the future? Dig deeper and look at what channels this business markets from, how it processes payments online, and even what laws it needs to follow in foreign countries. Getting a full run down on a business’s revenue model before purchase will reduce any unknowns and help you plan for pitfalls moving forward.

- Expenses/costs: You need to evaluate a business’s balance sheet to see what liabilities can strain future growth or any outstanding debt that needs to be paid off.

- SEO value: Online traffic is a key indicator of a business’s potential future value. However, you need to understand how that business monetizes that traffic and how steady that traffic is. Is this business getting most of its traffic from ads or a few blogs? It may not be a steady long-term investment.

- Brand value: Calculating brand value may require some different formulas, but I recommend calculating a business’s customer lifetime value (CLV) and marketing ROI for a rough estimate of its brand value. In addition, you can run a market or income evaluation to see the potential value of a business according to its fundamentals.

- Online sentiment: Like brand value, online sentiment and reputation may be more of a subjective interpretation. Nevertheless, consulting online reviews and using social listening tools to see how a brand is perceived can indicate its future value moving forward.

- Future earnings potential: Future growth potential is a great way to evaluate whether an online business has the potential to grow and increase its profitability over time. This analysis saves you from buying a business in a dying sector and also allows you to buy underperforming businesses at a discount.

- Terms of purchase: Of course, don’t forget to go over the terms and conditions of purchase with a lawyer before signing a contract to ensure everything is straight.

- Reason for sale: Finally, it never hurts to ask a business owner why they are selling a business. The reason could be innocuous, such as age, or outstanding liabilities could easily cloud any deal.

Tips To Accurately Price An Online Business

Finally, before you purchase a business, you must learn how to value a business appropriately. While deciding to purchase a business may be more of a gut feeling, acquiring it at the right price can be a quantitative decision.

Calculate EBITDA

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a neutral valuation formula that analyzes a business’s cash flow without too many inputs.

Essentially, EBITDA tells you how profitable a business is based on its capital structure and cash flow.

However, EBITDA should be used with other valuations and is not a substitute for a business’s net income or gross profit after accounting for taxes, interest, etc.

Use The SDE Valuation Method

The Seller’s Discretionary Earnings (SDE) method is a really simple formula for determining a business’s profitability after expenses are accounted for. The formula is as follows:

SDE = revenue - cost of goods sold - operating expenses + owner compensation

SDE is just as good of a representation of business value as EBITDA but can be more useful for companies with larger corporate structures with many more internal factors, such as owner compensation and benefits.

Multiply 12-Month Trailing Revenues By A Factor

Most businesses will give you a copy of their balance sheet or their 12-month trailing revenue to illustrate their profitability.

Add up the 12-month trailing revenue and then multiply by a factor between 3.5x and 6x, depending on the business’s age, anticipated years of profitability, and other financial metrics.

On the low end, we recommend multiplying your 12-month trailing revenue by 3x for most ecommerce businesses and up to 5x or 6x for more content or information-based websites.

You can also apply this factor to your EBITDA and SDE calculations for a rough estimate of price/value. However, SDE multiples will be lower than EBITDA because SDE accounts for more factors, such as salary and benefits, leading to a higher valuation.

Add A Discount Rate For Lack Of Marketability And Annualized Expenses

While these formulas are great at estimating the total value of a business from its earnings, these values don’t factor in other variables, such as expenses and marketability.

I recommend adding a discount rate for marketability, giving businesses that are harder to market (i.e., B2B and manufacturing) a higher discount rate than retail stores that are easier to market to a large crowd.

Your discount rate could be as little as 3% on the low end for an established ecommerce store and up to 17% or 20% for a small SaaS brand.

Additionally, apply a small discount for any annualized expenses that eat into your revenue, including administrative and banking fees. The higher your percentage of annualized expenses to revenue, the higher your discount should be.

Now that you understand what to look for and how to price an online business, I thought it would be helpful to list a few online exchanges you can look through to begin searching for online businesses in vertical.

9 Platforms To Buy And Sell Online Businesses

Unfortunately, Shopify’s app exchange was recently sunsetted, meaning you will have to turn to other sites to purchase ecommerce stores and businesses.

Nevertheless, these 10 websites and exchanges will allow you to research and find an online business to purchase.

1. Flippa

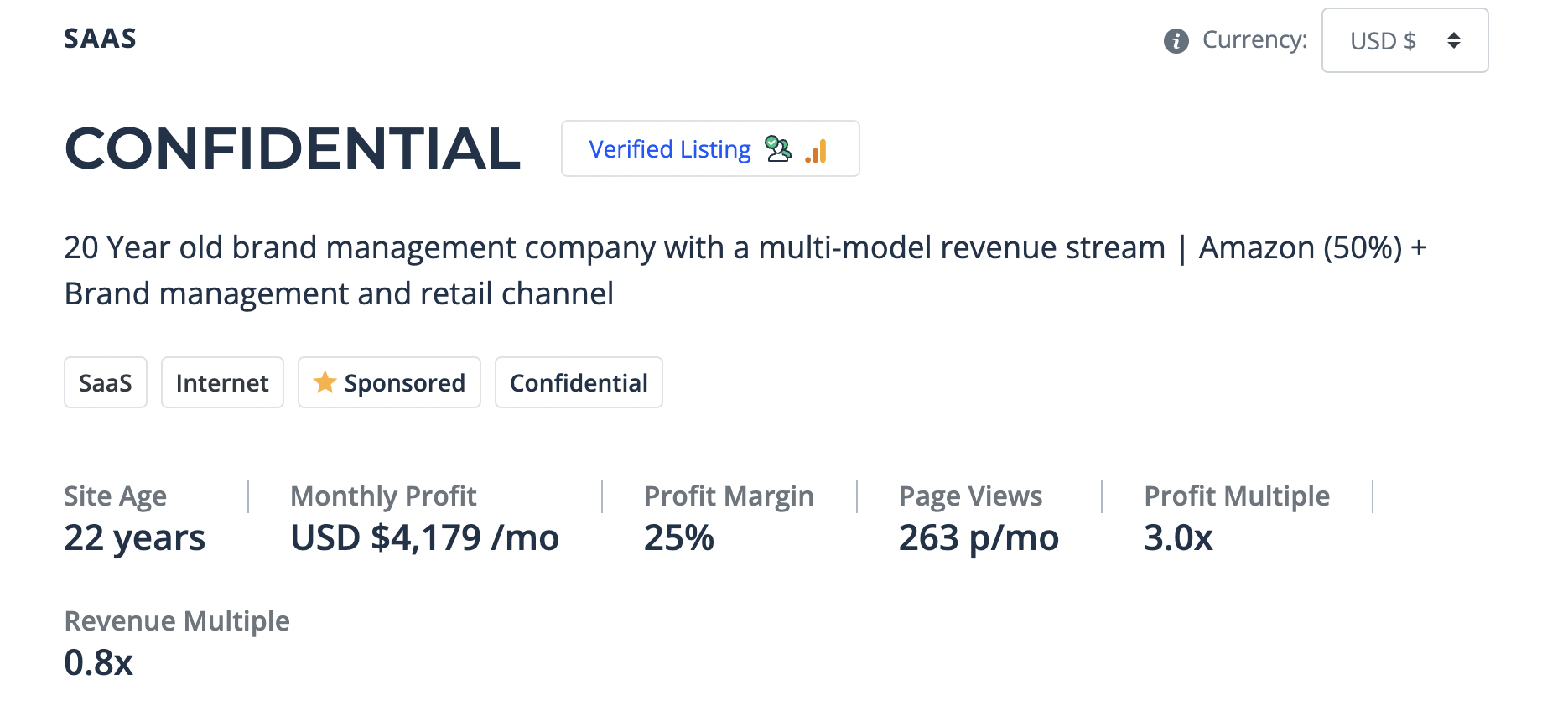

Flippa is one of the top online exchanges for online businesses, allowing individuals to search through listings like they would on Zillow or Redfin.

Best of all, Flippa provides valuable financial metrics, such as monthly profits, profit multiples, revenue multiples, and the website’s age.

Screenshot from Flippa, December 2022

Screenshot from Flippa, December 2022You can even search for individual categories on the site, using filters, such as “SaaS,” to find a SaaS business for sale.

2. Empire Flippers

Empire Flippers is another great site for individuals looking to purchase a business via a broker or direct exchange.

This platform vets buyers and sellers beforehand and even provides data from Google Analytics and other online sources to help you analyze the value of a business beforehand.

3. FE International

FE International allows you to buy and sell large businesses with investor interest in the SaaS, technology, content, and ecommerce verticals.

Unlike other platforms, FE International provides advisory services for mergers and acquisitions, accounting, exit planning, and much more.

4. Sideprojectors

Sideprojectors is a unique marketplace for people looking to purchase side project business ventures for a little extra cash.

Most of the websites you find will be built with automation for activities, such as crypto staking, drop shipping, advertising, and anything you can think of.

Luckily, this site vets all buyers, and you can purchase a side project for as little as a few thousand dollars.

5. AcquireBase

AcquireBase is a relatively new exchange specializing in startup websites and businesses for low prices.

While these projects may require a little more work, they could provide you with the perfect in-between to snag a successful online business at a low price with an established brand.

6. Motion Invest

Motion Invest is a third-party exchange specializing in content-specific websites.

This exchange provides free valuation services and is a great source to find blogs and informational websites in your niche.

7. BlogsforSale

BlogsforSale is more of a boutique option to find specialized blogs, such as Mommy blogs.

Additionally, this site provides a bevy of helpful tools, such as due diligence research and free valuation tools, to help price any business you’re looking to buy or sell.

8. Business Exits

Business Exits is another standard online exchange designed to help people sell their online business and close on sales quickly and efficiently.

I would definitely recommend this site as highly as Flippa or Empire Builders, especially if you’re selling your business.

9. Latona’s

Latona’s is an online brokerage that can help you acquire online businesses via a wide range of tools and listings.

Search for businesses over listings and use their powerful search tool to help you find an online business that is right for you.

Additional Platforms And Ideas

If you haven’t found an online business that satisfies your requirements, you can always use existing platforms to carve out a business in any niche.

For example, no online business can operate without a domain name, so why not make a business of it?

If done correctly, purchasing domain names is a great way to make money at very little cost.

Additionally, other resources, such as Fulfillment by Amazon, can provide a great source of revenue by doing dropshipping.

And affiliate marketing is a great way to capitalize on an established brand using very little marketing work.

Conclusion

With so many different industry verticals and ways to make money online, you don’t always need a new or unique idea.

Sometimes purchasing an established business and giving it your own spin can be a great way to make instant profits when other people are struggling as startups.

More resources:

- Drive Online Sales With These 5 Search Optimizations

- Local SEO Guide For Ecommerce & Online Ordering

- Ecommerce Marketing: The Definitive Guide

Featured Image: Eakrin Rasadonyindee/Shutterstock

![AI Overviews: We Reverse-Engineered Them So You Don't Have To [+ What You Need To Do Next]](https://www.searchenginejournal.com/wp-content/uploads/2025/04/sidebar1x-455.png)