As the Coronavirus pandemic stretches on, uncertainty about when and how it will end has driven nervous commitments to ad budgets.

The initial pullback of funds is now leading to larger questions:

How much money is now not being spent and what does that mean?

eMarketer Initially Projects Paid Social Hit Hardest

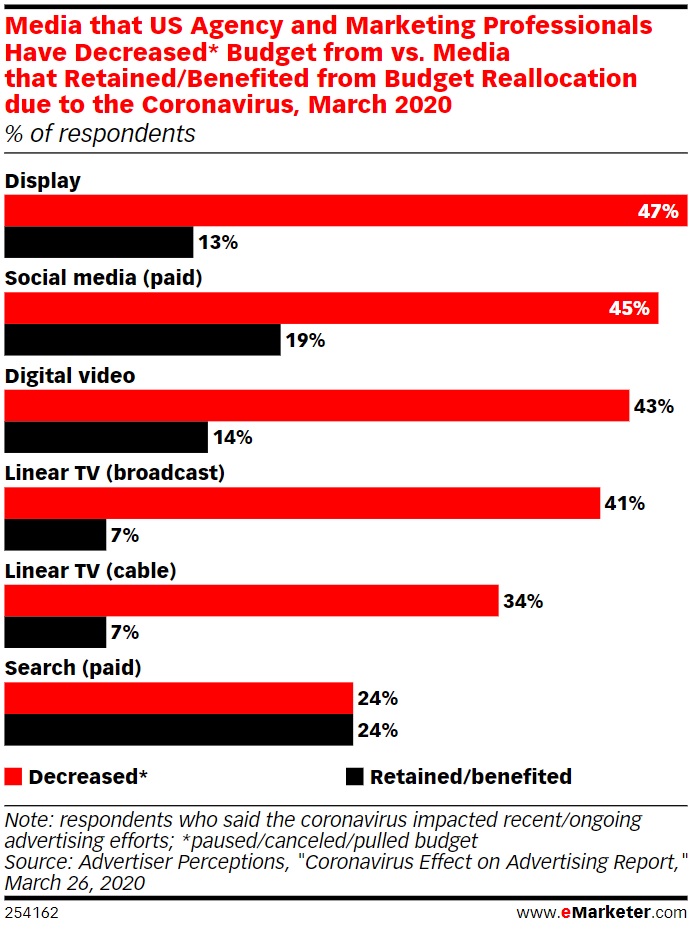

In the latter half of March, eMarketer surveyed 203 respondents. 67% were agency-side, and 33% were marketing professionals, but all work functionally in media decision-making.

Participants were asked two questions:

- What media types were they choosing to pause/reduce spend from, based on their initial response that they would be doing so

- What media types would keep or receive funds shifted away from other channels?

The initial data reflected the largest decreases in display and paid social, followed closely by digital video.

Paid search fared best, with the lowest decrease response, and highest retained budgets.

This was logical, given that search is heavier on demand-side, versus other channels that lean more toward top or mid-funnel efforts.

The Paid Search COVID-19 Realities We See in April

As the Coronavirus has moved from an initial unknown entity into the “new normal” of our day to day, the realities of how cuts are playing out have become clear.

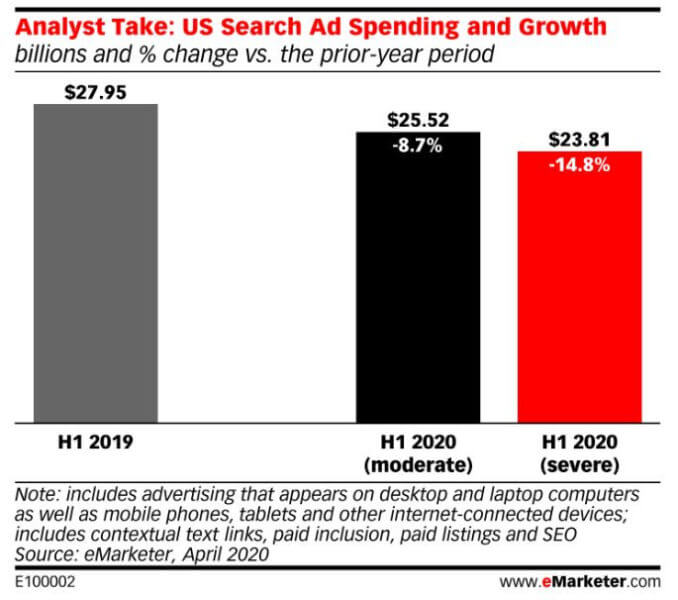

Despite the initial survey that had paid search as the most stable channel, underlying factors are driving steeper decline projections now.

A study performed last week by eMarketer shows their latest projections on the impact of ad spend, specifically for paid search.

The model shows a year-over-year reduction of anywhere from 8.7% to 14.8% as the worst case scenario.

This equates to a loss of anywhere from $2.5 billion to $4.2 billion.

Beyond the usual brand and advertiser pull-back, there are also larger marketplace entities that fuel the paid search engine.

One of those entities is Amazon.

Amazon has reportedly slashed spend not only in response to demand, but also as a mechanism of them focusing their efforts on essential items for consumers.

Is the Paid Social Forecast Coming True?

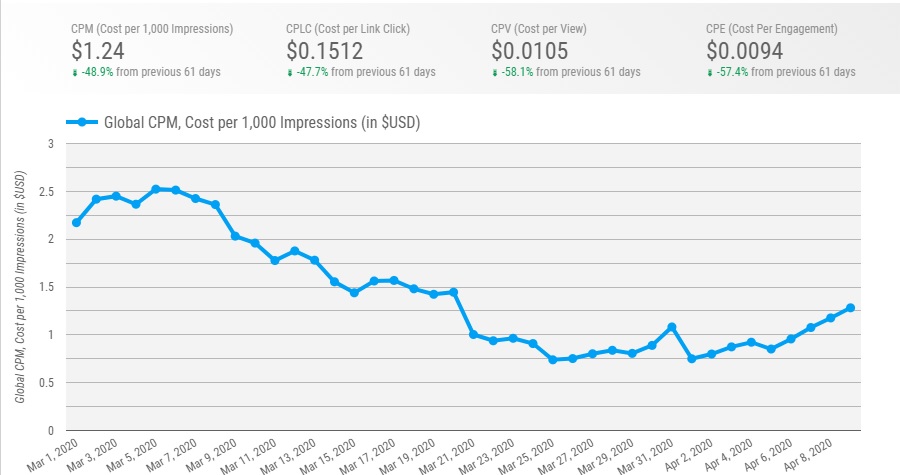

Boston-based Gupta Media has created a daily-updated dashboard that is aggregating the effects they’re observing in Facebook Ads.

It can be filtered by placement and country (separately), with breakdowns between Facebook Feed, Instagram Feed, and Instagram Stories.

The aggregate graph reflects a massive 49% drop in CPM costs as of the time of this writing.

Aggregate Facebook data, courtesy Gupta Media

Aggregate Facebook data, courtesy Gupta MediaGiven the plethora of ad types and objectives, and the varying costs they carry, the graph notes it’s believed to be an accurate reflection of those factors.

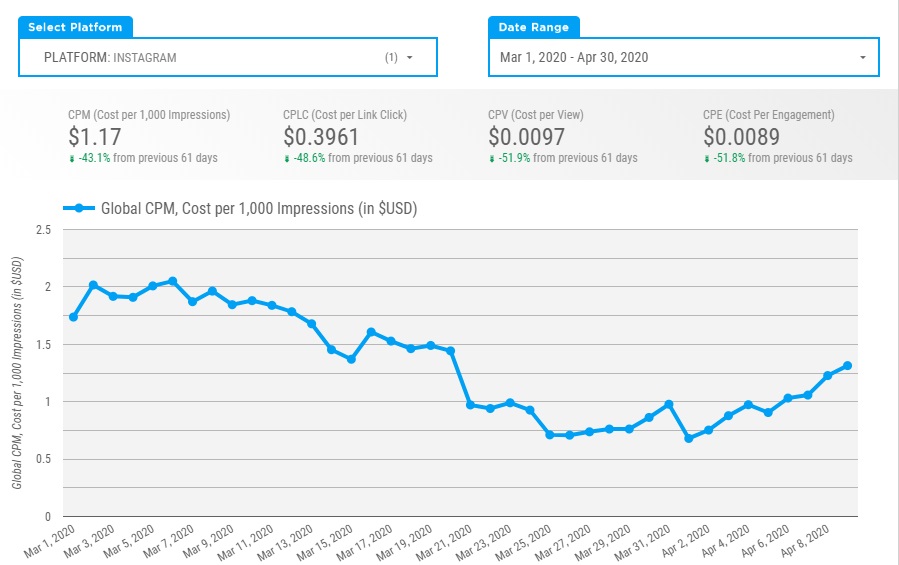

When viewed as a split, it becomes clear where the uptick seen in the above graph is coming from: Instagram.

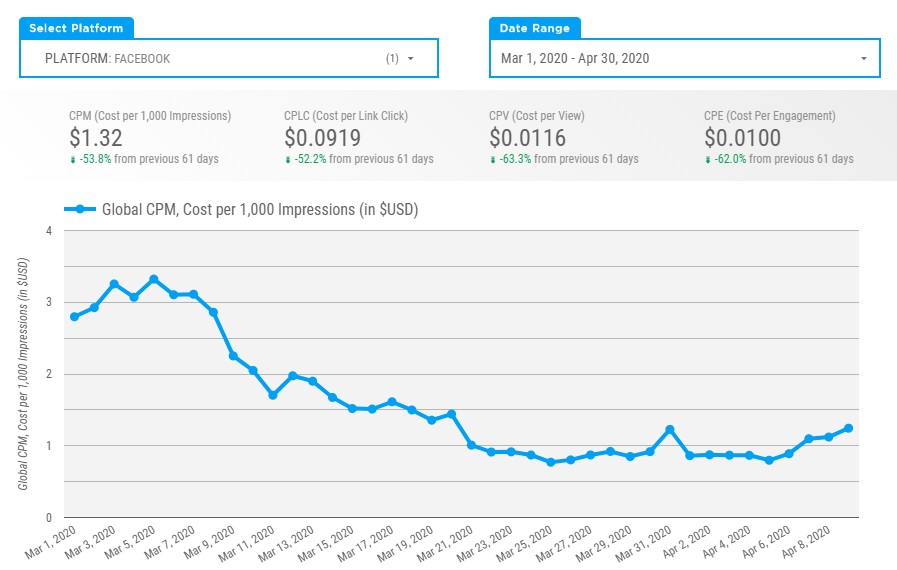

Here is Facebook’s trend, minus Messenger and Ad Network:

Facebook-only trend, courtesy Gupta Media

Facebook-only trend, courtesy Gupta MediaThis is in striking contrast to Instagram, which has showed a steeper crawl back up:

Instagram-only metrics, courtesy Gupta Media

Instagram-only metrics, courtesy Gupta MediaThe full tool can be accessed and used for free here.

David Herrmann, a direct-to-consumer Facebook Ads expert, is experiencing these cost decreases – but there’s a catch.

“From a cost perspective CPMs are way down, however conversion isn’t necessarily up across the board,” Herrmann said.

Andrew Foxwell of Foxwell Digital also notes the supply issues that have been experienced, with manufacturing in China just now firing back up.

“There are a clients with inventory issues…so even though numbers look good they’ve had to shut down,” Foxwell said.

It Isn’t Doom & Gloom for All Brands

Brandon Doyle, founder of Wallaroo Media, created a spreadsheet tracking all of their ecommerce client trends.

While the CPM trend is certainly in line with the drop, their conversion rates have increased notably, with March and April showing some of their strongest conversion rates in 2020.

These trends aren’t limited to the U.S.

Canada-based Duane Brown notes the current ad experience feels very pre-2017, both in terms of cost and ease of sales.

“This feel like 2016 when you could launch almost any ad and it’d work,” Brown said. “Even IG Story Polls are doing well in Canada. Last year they could be hit or miss because of a smaller inventory and our country size.”

Gil David also weighs in with similar experiences from the Ireland market.

He notes a home kit related to cooking has experienced a CPM drop of 39.95% to £3.98. It’s the lowest ever in the account, but while also increasing spend 6X to over £2k daily also the highest ever.

“CPA is down 43% and ROAS has increased 87% to 2.5X – another record seeing as we are profitable here anything over a 1.3X. This period has been transformational for the business especially being on track to hit £100k in FB revenue alone and they’ve actually had to hire more staff to deal with the volume,” David said.

While the vertical and product can matter in these times, there are even bright spots among areas may people assume there wouldn’t be, such as apparel.

“Our shoe client has virtually sold out of our entire stock in 3 weeks. We changed messaging around looking cute in doors and breaking the shoes in before summer (camping boots) and we had our highest ROAS. We sold out of our 4,000 shoes in 2 weeks,” said David Herrmann.

Image Credits

Images 1-2 courtesy of eMarketer

Images 3-5 courtesy of Gupta Media

![AI Overviews: We Reverse-Engineered Them So You Don't Have To [+ What You Need To Do Next]](https://www.searchenginejournal.com/wp-content/uploads/2025/04/sidebar1x-455.png)