Forecasting is one of those… things. There’s a myriad of thoughts running through your mind.

Each thought casting doubt in the accuracy of your glorified guess.

Do I aim low or high? What if I’m wrong?!?

What is competition going to do this year?

There are so many unknowns, how can I predict what’s going to happen when I’m not a wizard?

You have far more information available than you can imagine.

SEM forecasting is a series of educated guesses at its core. It’s a good place to deploy some basic game theory principles.

Forecasting is playing a game with incomplete information, much the same as the Google Ads auction.

We know the outcome that we want (growing conversions), but we don’t have complete information on the economic condition of the auction.

I recommend readers either learn from Annie Duke, former poker player and author of Thinking in Bets. She lays out a series of decisions and quantification methods to make the right choice with incomplete information.

Here’s a link to the book itself, a podcast, and a lecture at Google to review.

While we’re always dealing with incomplete information, we do have options. We can use history to make a series of educated guesses to get forecasting a little right-er.

Before you start you’ll need to segment your traffic into performance pools. That is, break your campaigns into traffic sets where conversion rate and/or CPCs are materially different.

If you’re maxed out on brand but apply the same growth level to… everything, you’ll wind up missing by a mile.

I recommend segmenting your PPC forecast into four main categories:

- Branded.

- Non-brand.

- Remarketing.

- Display prospecting.

I’d also recommend diving into devices – mobile vs. not mobile is sufficient.

You can go deeper or stay in the shallow end if you prefer, but these vary enough to warrant their own individual forecasts.

What follows is a walk-through of assumptions I make during forecasting to help guide decision making and get things right.

1. CPCs + CPMs Will Increase Year Over Year

“Why am I paying more for the same?” asks the CMO.

Because inflation and Wall Street, that’s why.

If your account has history, try to map CPCs out over a few years to see how they’ve trended to guide your decision.

If it’s a newer account, your best bet is to trust Google’s planning tools and build in a mid-year reforecast.

This year has proven to be a bit more variable than years past, but a 10% increase in CPC/CPM is generally a safe assumption.

2. Conversion Rate + Order Value Won’t Change Unless You Change It

If your conversion rate was 3% for non-branded mobile campaigns last year, it will be 3% next year.

If you don’t do any testing, no improvement will happen.

If you do test (which you should), adjust your assumptions. An increase of 25% (e.g. 4% to 5%) isn’t outside the realm of possibility if you do make a significant investment.

If you want testing tips, check my tips for improving PPC landing pages.

If you’re starting from scratch, it can be a bit more challenging to forecast. A safe assumption is that your brand campaigns will correlate with direct traffic, while non-brand will be close to organic.

3. The Calendar Will Change, As Should Monthly Forecasts

Black Friday 2018 was November 23, which meant Cyber Monday fell in November.

Black Friday 2019 is November 29, meaning Cyber Monday will fall in December.

Christmas this year is on a Wednesday (vs. Tuesday last year), meaning we’ll likely be able to eke out a few more days of shipping.

The 4th of July is on a Thursday this year, meaning the entire weekend will be heavy on vacations.

Last year it was Wednesday, meaning it acted more like a short break than a summer holiday.

November and July will perform “worse” year over year. December, “better.”

Factor the environment in your forecasts by diving a bit deeper.

4. Competitors Will Stay Steady, As Will Auction Dynamics

We all know this isn’t true, but it’s the best we’ve got.

Competitors will come and go. Competitors will change their strategy… a lot.

Barring any significant external factors, you can safely assume the volume of competitive pressure will stay flat.

It’s rare to see a competitive set exponentially grow overnight – after all, there are only so many ad slots.

Competitors will come and go. They will adjust strategy, but the quantity and pressure (likely) will not.

5. Inventory Is Finite: The Next Click Costs More Than the Last

Everybody would love to get more traffic out of their best performing targets.

Unfortunately, there’s not always more traffic to go get!

If you’re already at 99% impression share or a high click share for your top performers … Sorry. You’re maxed out.

If there is inventory available, assume that incremental clicks will be more expensive than what you’re already getting.

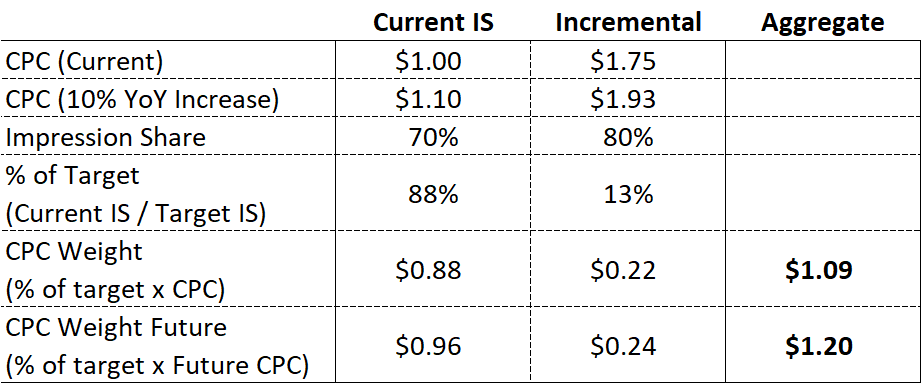

Say you have a 70% impression share at a $1 CPC and want to get to 80%. I’d assume the next “collection” of clicks will come at a $1.75 CPC.

In turn, your aggregate forecast would be at a $1.09. If you’d like to include the YoY CPC increase, the “rightest” forecast would be at $1.20.

Math outlined below, but also check out Hal Varian’s (very old) video on bidding. The link points to the specific point about incremental costs.

The lone exception to this rule is being limited by budget. If your campaigns are budget constricted, you’ll be able to open forecasts at the same-ish rate.

6. Investments in Top of Funnel Will Influence Bottom Funnel Inventory

This segment may be the hardest one to quantify, but is also likely the most important.

There are two questions tied to each marketing effort:

- The direct response.

- The down-funnel effect.

Think of it this way:

If you launch a big display campaign, you can assume that it will cause some material lift in brand volume and retargeting campaigns.

Exactly how much of an influence is a bit more challenging.

Take a look at previous efforts to see how much of a down-funnel effect it had. After all, yesterday is usually the same as tomorrow

But Wouldn’t It Be Easier to Forecast in Tiers?

Well, yes and no.

Creating layers of assumptions to draft high-medium-low forecasts gives you more of an opportunity to be right. But it diminishes the value of your assumptions as the forecast moves up the chain.

CEOs don’t want three scenarios we think might happen – they want one thing they can take to the board.

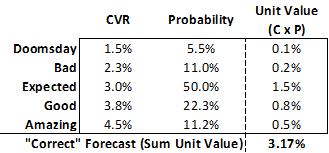

Instead, think in bets! Add a gut-based probability to each outcome, weighting the likelihood of each.

Once you start assigning a bit of math to these assumptions, the “right” forecast to a metric becomes crystal clear.

Below is an example of how to think about it for conversion rate. We expect conversion rate will be 3% – it may rise or fall, but we expect it’s twice as likely to soar than it is to fall.

Summary

Remember dear readers, a forecast is a guess based on assumptions.

The clearer and more defined your assumptions, the more precise your projection.

As long as you lay out every assumption behind a forecast, there is no way a forecast will ever be wrong!

More Resources:

- 4 Tips to Avoid PPC Forecasting Pitfalls

- How to Create a Paid Search Media Projection

- PPC 101: A Complete Guide to PPC Marketing Basics

Image Credits

All screenshots taken by author, June 2019

![AI Overviews: We Reverse-Engineered Them So You Don't Have To [+ What You Need To Do Next]](https://www.searchenginejournal.com/wp-content/uploads/2025/04/sidebar1x-455.png)