Marketers are scrambling to adjust their SEO strategies to account for the COVID-19 pandemic.

That’s why it’s important to explore its impact on search interest trends and organic performance in retail.

As more users stay home and avoid public places, we understand that there is a shift in online behavior.

We have examined these initial behavioral shifts in the age of COVID-19 to better understand the retail landscape.

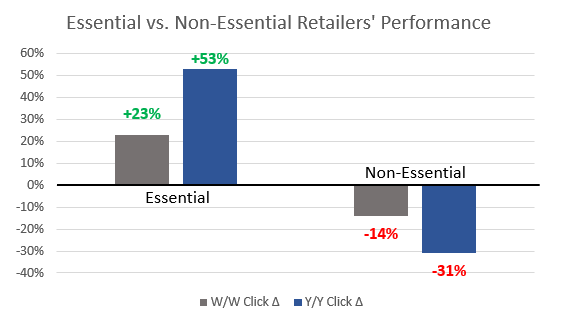

Our initial findings show that there are two categories of retail sites experiencing opposite organic impacts:

- Retail sites that carry essential goods have experienced positive organic traffic growth.

- Retail sites that carry non-essential items have experienced organic traffic declines.

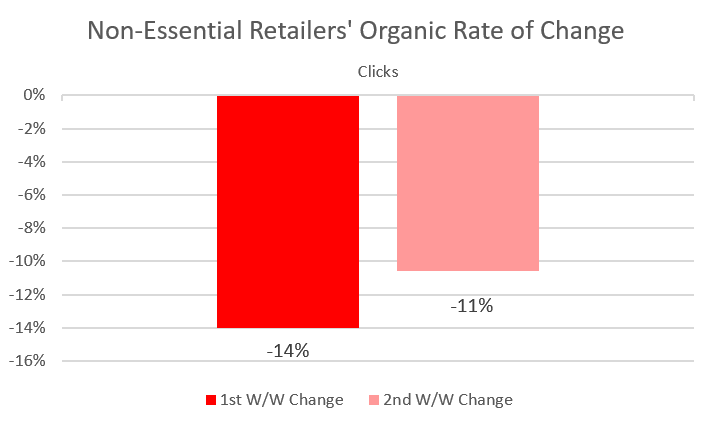

Additionally, essential retail sites are seeing accelerated growth in clicks two weeks after the initial data collection, while the rate at which non-essential retail sites are losing traffic is slowing.

Methodology

We chose to examine retail clients because their bottom line is being directly and instantly impacted by the lack of consumers visiting their brick-and-mortar stores.

We examined:

- 53 Merkle retail client properties.

- Broke each retailer into either essential and non-essential for a pandemic

- Examples of essential retailers: grocers, drugstores, general big-box merchandisers.

- Examples of non-essential retailers: apparel, home goods, specialty big-box merchandisers.

- Looked at year-over year, first week-over-week, and second week-over-week dates.

- Year-over-year dates: 3/9/20 – 3/15/20 compared to 3/9/19 – 3/15/19.

- First week-over-week dates: 3/9/20 – 3/15/20 compared to 3/2/20 – 3/8/20.

- Second week-over-week dates: 3/16/20 – 3/22/20 compared to 3/9/20 – 3/15/20.

Note: The Essential vs. Non-Essential Retailers’ Performance uses first week-over-week data.

Results

The Novel Coronavirus (a.k.a., COVID-19) has had a mixed impact on organic performance across retail clients.

There were two primary retail categories that arose as having opposite performance impacts:

- Essential retail (e.g., grocery stores)

- Non-essential retail (e.g., clothing stores)

Non-essential retail sites are seeing negative week-over-week (W/W) and year-over-year (Y/Y) organic click changes, while essential retail sites are seeing positive changes, as seen in the chart below:

Additionally, essential and non-essential retailers are experiencing opposite rates of change W/W, as seen in the charts below.

- Essential retailers are gaining organic traffic at an accelerated rate each week.

- Non-essential retailers are losing organic traffic at a slower rate.

Analysis

Why are we seeing these changes in search performance across essential and non-essential retail sites?

There are many reasons – including changes in user search behavior.

For example, the lack of travel during this year’s spring break has influenced pre-travel searches and merchandise purchases like spring break attire.

Additionally, the growing concern of the coronavirus has likely disrupted users’ typical search patterns and redirected their attention away from more traditional retail searches to more timely searches that reflect their concerns.

This overall shift in search interest has likely contributed to the drop in organic performance of non-essential retail sites.

Also, users are trending positively toward essential searches over non-essential searches as they pivot their search interests to adjust to the necessary COVID-19 lifestyle changes.

For example, the image below displays the trended search interest of “groceries” (an essential retail search) compared to “swimsuits” (a non-essential retail search) over the past two years.

Historically, search interest in “swimsuits” has been higher than “groceries” during mid-March, but search interest for “groceries” has far surpassed search interest in “swimsuits” in the past few weeks.

This further emphasizes the landscape changes we are seeing as users have less interest in spending at non-essential online retailers and more interest in preparing their homes for the pandemic.

eMarketer reports that:

- Almost half of the U.S. users polled by Coresight Research in February 2020 were avoiding shopping centers and malls due to the coronavirus outbreak at the time of the data collection.

- Almost three-quarters of users planned on staying away from shopping centers if the outbreak worsened.

As concerns over the COVID-19 outbreak grow, the number of users avoiding brick-and-mortar locations will also likely continue to grow.

However, according to Andrew Lipsman, a principal analyst at eMarketer, users’ “household needs don’t simply go away and may even increase, with many looking to stockpile resources.”

As the concern about COVID-19 rises, we expect users to be more concerned with stocking up on essential items in the coming weeks.

Non-essential retail sites that have historically seen positive organic performance during spring should be prepared to experience Y/Y declines, as users adjust their online search behaviors to reflect their coronavirus concerns.

However, there is the possibility that as users adjust to at-home lifestyles, ecommerce shopping could increase as users move their traditional spending from brick-and-mortar to online.

The future of retail in the coming weeks will be constantly changing, and we expect organic performance to reflect this uncertainty.

Takeaways

- Essential and non-essential retailers are experiencing opposite organic performance changes during the COVID-19 pandemic.

- Essential retailers are being positively impacted.

- Non-essential retailers are being negatively impacted.

- These performance impacts are likely influenced by a significant shift in user search behavior that reflects the concerns of users during the pandemic.

- The organic search landscape continues to shift each week. Essential retail sites are experiencing accelerated W/W growth, while non-essential sites are experiencing slowed organic losses.

- As the ecommerce organic landscape continues to change, here aresome essential SEO practices you can do to help your site (and brand) be as strong as possible during the coming weeks.

- Monitor your keyword profile for coronavirus and COVID-19 queries to understand user concerns.

- Create messaging around how your business is supporting its customers during the outbreak, such as new takeout and delivery options for restaurants and shipping changes for ecommerce brands.

- Review the Google Webmaster Central Blog’s recommendations on how to pause online businesses, including limiting cart functionality, updating structured data, and requesting crawling of pages that contain changes in Google Search Console.

- Leverage new structured data types to better communicate business updates, such as changes to events, due to the coronavirus outbreak.

- Adjust your Google My Business profile to reflect changes to brick-and-mortar store hours.

- Monitor query-level performance changes in the coming weeks to adjust organic search strategies, as needed.

More Resources:

- 5 Completely Sane Reasons Why You Shouldn’t Stop SEO Efforts During COVID-19

- Working with SEO Clients: Strategies for Now & After COVID-19

- 7 Ways COVID-19 Is Affecting Search Traffic & How SEOs Can Respond

Image Credits

All screenshots taken by author, March 2020