New year, new platform!

I think we’re all pretty immune to the general announcement of a new advertising option anymore, it’s all about the three follow up questions:

- How much? (CPC, commission, minimums)

- What will I get for it? (revenue, sales, volume)

- Is it worth testing now or waiting? (Because you know you’re going to test it, it’s just a matter of when.)

Well, good news, it’s not my first rodeo either.

Let’s walk through what’s up with Walmart and how you can take advantage of the giant retailer’s latest ecommerce offering.

First, let’s set the stage a little – context is king after all.

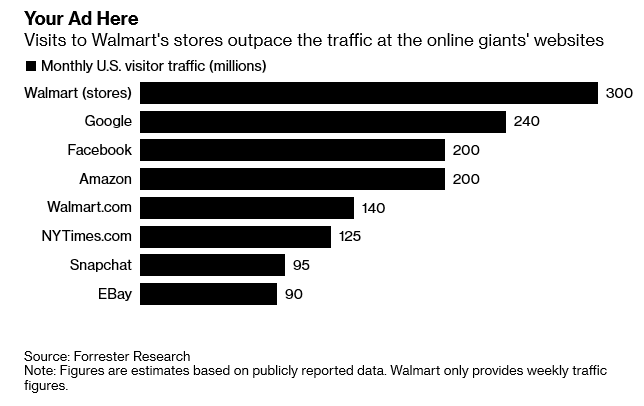

There’s pretty much not a human in the U.S. that doesn’t know what Walmart is and chances are, lives within 15 miles of one. 90% of the continental U.S. population can get to one of 4,769 locations.

That’s pretty insane and their foot traffic matches.

Walmart also invested over $1 billion into their ecommerce business in the last year (or “lost” depending on how you like your glasses) – but is reporting significant double-digit growth, quarter over quarter, most being attributed to online efforts and grocery pick-up.

It makes total sense.

I have two kids under the age of four and I will actually avoid places that do not have a drive-up option.

The thought of unstrapping them, bringing them in, managing the chaos and then strapping them back in is a special exercise in patience that some days, I just don’t have.

That’s some pretty significant ground made in the last year – but the immediate opportunity in front of us today is the sponsored products ad unit for marketplace sellers.

Does the effort in general online ecommerce efforts match what’s happening in the marketplace?

The Walmart Marketplace

Originally created for a handful of select sellers, the Walmart Marketplace is actually 10 years old.

It has slowly grown from there to 33,000 sellers today – with 10,000 sellers added in the last year alone. (For comparison, Amazon has more than 3 million sellers today.)

This means that technically, competition is much lower for sellers, and advertising.

The first step being that seller piece.

There is an application process and sellers must pass through a few gate checks on the way, but if you’re currently selling on Amazon or eBay, chances are you’re fairly set up for this.

If you’re not, this isn’t something to enter in lightly.

You must be able to meet seller standards, which means retail readiness – and that is a whole other, lengthy post.

There are a lot of great seller guides out there for Walmart specifically and for multi-marketplace selling (if you’re already on Amazon) sellers if you want to expand your reach.

I’m going to stick to advertising on this post, specifically:

- An overview of sponsored products the immediate opportunity.

- A little on buy box banners and search brand amplifiers.

Sponsored products are available to any seller (after applying for it as a current Walmart seller) through self-service platform for management. I’ll go into that ad unit in greater detail.

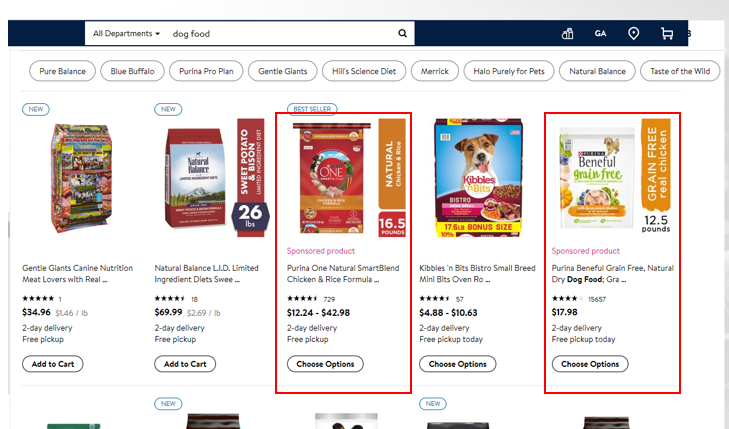

The buy box banner is a placement that is only available via automatic campaigns (in that self-service platform) with a high enough bid (greater than $1) but otherwise cannot be selected by itself without the help of the Walmart Media Group.

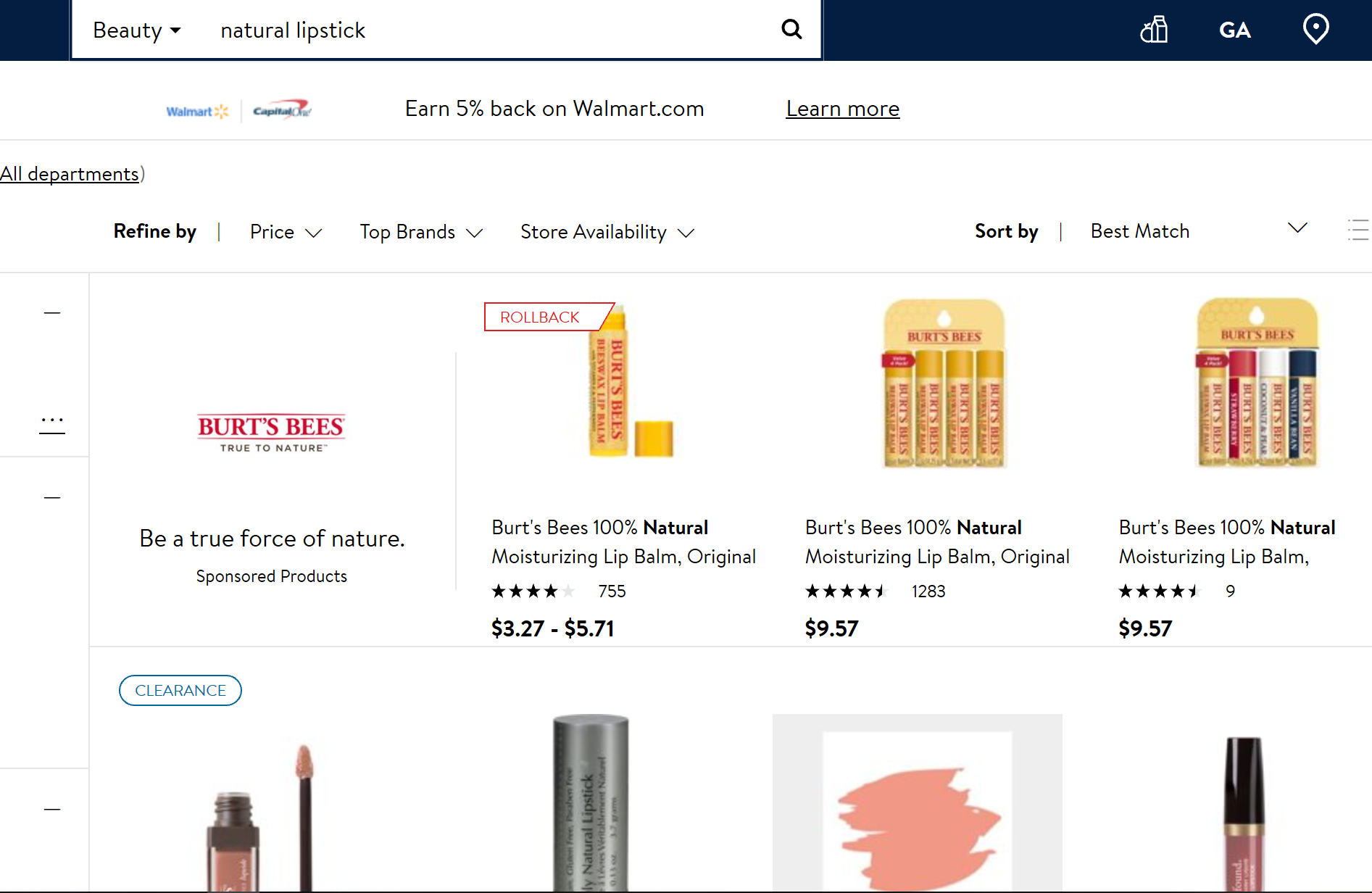

The search brand amplifier is for head/generic terms only (like “dog food” or “natural lipstick”) and is only through a managed service with the Walmart Media Group (WMG).

These are the most common ad types you’ll see on the Walmart experience today. There are additional placements in video (Vudu, anyone?) and display, but are again, all managed with WMG.

Walmart Sponsored Products

Very similar to the Amazon Sponsored Product ad unit, the Walmart Sponsored Product Ad can appear:

- After a search in a result in the grid.

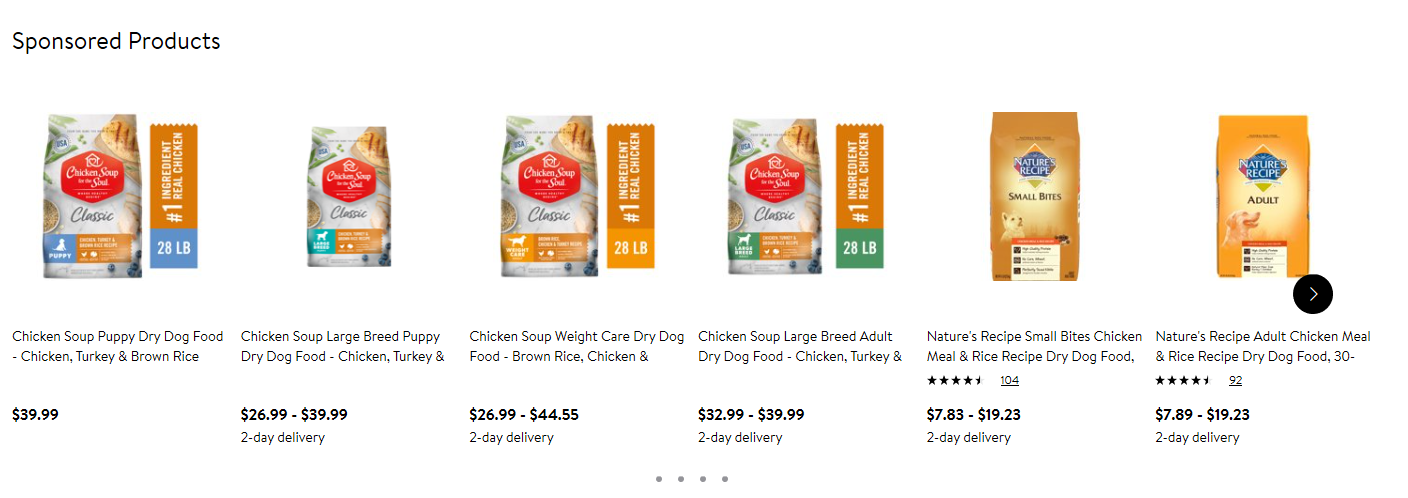

- On a product detail page in a carousel.

- On browse and category pages.

…the bulk being in search and product pages.

For search, in-grid, the ads can appear in the 3, 5, 6 and 12th slots, no more than 2 on the page and the seller must rank organically for that term in the first 128 products or 3 pages.

The advertised product must also be winning the buy box to be eligible.

It’s a keyword-based, match types (broad, phase and exact) CPC model advertising– campaigns and product groups.

But the biggest difference from Amazon and Google is that it’s a first-price auction, meaning that the amount you bid is the price you will pay, not .01 less like we’re used to in a second price auction.

There are two campaign types:

Automatic Campaign

This type of campaign allows you to:

- Add products to ad groups and do not choose keywords.

- Let Walmart automatically target and serve on relevant placements.

Manual Campaign

Here, you select the keywords in which your ad groups of products are relevant for.

The minimum bid for an automatic campaign is .20 and for a manual .30 and the daily budget is $100 minimum and $1,000 for the campaign.

That’s not necessarily the amount you will pay over the lifetime of the campaign, but the minimum Walmart requires input during the campaign setup.

(Personally, my paid search OCD kicks in and really doesn’t like that, even if the campaign may never hit that spend amount, ever. But it is what it is.)

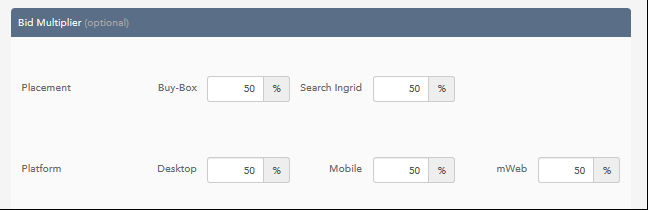

There are bid multipliers available as well – to boost those minimums or base bids for specific placements and platforms (devices, really) that are percentage-based.

This is set at the campaign level and for automatic campaigns – ONLY.

The biggest differences in campaign setup are around volume.

The number of products that an ad group needs in it is more than Amazon or Google, it needs at least 10-20 SKUs to be able gather enough volume and data, especially an automatic campaign, to perform effectively.

The onsite search sophistication of the Walmart algorithm for results is not the same as Amazon or Google’s either.

So when choosing keywords for a manual campaign, it’s best to look at the suggested keywords tab and choose the first 10-20 there.

These are keywords that Walmart has identified as relevant on their platform, you can add you own “additional keywords” terms that you curate and add yourself.

A good place to start with those is your brand terms, those will not necessarily be on the suggested list, especially with a new campaign.

Like Amazon or Google, you do want to take keywords from automatic campaigns and “harvest” them for use in manual campaigns. That said, there will not be a need to review and harvest as often because of the volume of sales and because there won’t be as many relevant keywords to add that will make sense.

There is also a 2,000 keywords limit on a per ad group basis – which does tend to add up fast, plus the maintenance of those keywords going forward.

(And there is no negative keyword capability at this time. I know, I know. Chill.)

What We’re Seeing

Performance has been hugely dependent on:

- The category.

- The seller’s seller metrics.

- Budget.

- Number of products in the catalog.

- Patience during the ramp-up period – which could be 1-4 weeks.

There have been plenty (hundreds of thousands) of impressions in automatic campaigns, but the click-through rate is ranging in the 1% or less area on average for third-party sellers.

The Buy Box banner on product detail pages has the best click-through rate so far.

In-grid sponsored products search results have the most volume and a comparable click-through rate.

We are seeing that recognizable brand names and brands with a well-established Walmart instore presence enjoy a much higher click-through and conversion rate – those tend to have first party or vendor relationships as well.

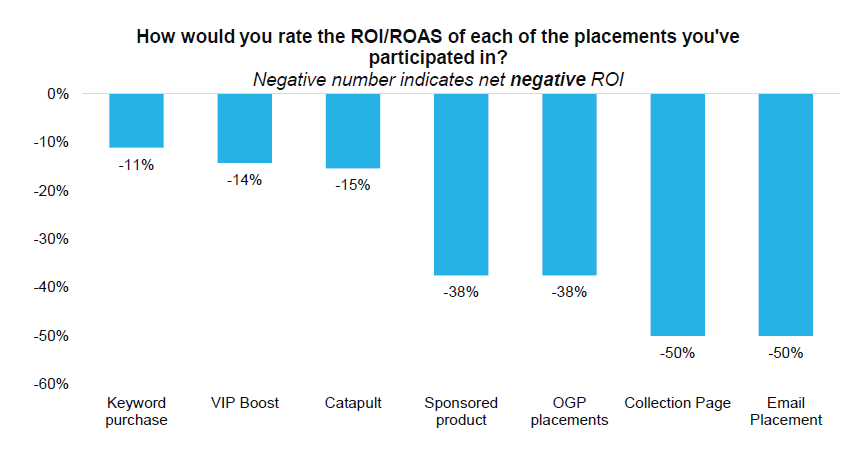

Most folks I’ve talked to, as well engaging a third party, the Cleveland Research Group (February 2019 Supplier Benchmark Survey below), have found that despite any trials or hiccups they’ve had, they’re all willing to continue on as features and functionality roll out since the potential volume and opportunity is great – after Amazon, Google, and Facebook.

So What’s Next?

As mentioned, you’ll need to not only be a seller and apply for advertising, but you’ll need to consider a few other pieces of info.

- Walmart has stated that advertising can improve organic ranking over time. So, similar to what’s happened on Amazon and Google in terms of number of paid and organic slots available in search result, this may end up being another table stakes type of expectation of being a seller.

- New products, struggling SKUs and seasonality can benefit the most from advertising IF you also have the product content to back it up. Remember, just being visible doesn’t increase conversions. It helps, but you still have to be competitive on price and WHY your widget.

- Two-Day Ship badge helps a lot – but to get it, you need to be able to meet shipping and fulfillment requirements. That can be tricky, as your product needs to be in key warehouses across the country in order to qualify and show as in stock across the U.S.

- Early days means not as much data to work with and in some cases, inconvenient to access or aggregate. Get ready to build your own tools, templates and make it work.

Convinced?!

If you’d like to learn more about being a seller or apply for advertising, visit the Walmart Media Group site.

More Resources:

- The Rise of Advertising on Ecommerce Marketplaces: 5 Tips to Get Ahead

- Buy Online & Pick up In-Store: How It’s Changing Everything from Daily Groceries to Holiday Shopping

- Ecommerce Marketing: The Definitive Guide

Image Credits

All screenshots taken by author, February 2020

![AI Overviews: We Reverse-Engineered Them So You Don't Have To [+ What You Need To Do Next]](https://www.searchenginejournal.com/wp-content/uploads/2025/04/sidebar1x-455.png)