When PayPal hit the ecommerce scene, it revolutionized the way online businesses conducted sales transactions.

As a free way to make virtual payments, PayPal made shopping easier for consumers and business owners alike.

At the click of a button, people could send money without sharing sensitive information such as credit card or bank account numbers.

It gave people the confidence they needed to shop online, and made it easy for business owners to accept universal payments.

Today, there are more than 286 million people using PayPal to make online purchases, and it’s no wonder why.

PayPal is:

- Fast: It saves your information, so you don’t have to fill out payment forms every time.

- Easy: You can send money with your PayPal balance or from your bank account with no added fees.

- Secure: They don’t reveal payment account details and they work hard to keep your information safe.

There’s no question PayPal is a great service, but like any system, it isn’t without its faults.

Some of its main drawbacks are:

- Reaching customer service can be difficult.

- Digital goods aren’t covered by PayPal seller protection.

- Fees are higher than some other providers.

- PayPal can freeze accounts without warning.

- Transferring money to your bank account can take days.

The good news is that PayPal isn’t the only digital payment service provider on the market.

Take a closer look at these alternatives and choose the one that makes the most sense for your customers and your business.

1. Google Pay App

- Established: 2021

- Pricing: Bank transfers and debit card activity is free. Credit cards charge 2.9% of the transaction amount.

Google Pay is an app that offers benefits for both sellers and consumers.

Users can save credit and debit card payment information to their Google Pay accounts for quick and easy payments from virtually anywhere.

Businesses are not only able to streamline the payment process for their customers but can use this service as a digital marketing tool, sending mobile offers and product recommendations to a targeted audience.

Google is a widely recognized and highly trusted company, so people feel comfortable trusting them for their online payment needs.

2. Square

- Established: 2009

- Pricing: Each transaction is charged a 2.9% fee plus $0.30.

Initially launched as a solution for mobile POS transactions, Square’s digital readers allow customers to make credit card, cash, and check payments.

It now features tons of benefits for online transactions through virtual invoicing and real-time inventory management.

Square even offers payroll support, letting employees clock in and out of work and accept payment via direct deposit.

One highlight is that Square grants small business loans, with percentages of daily Square sales going toward the loan payment.

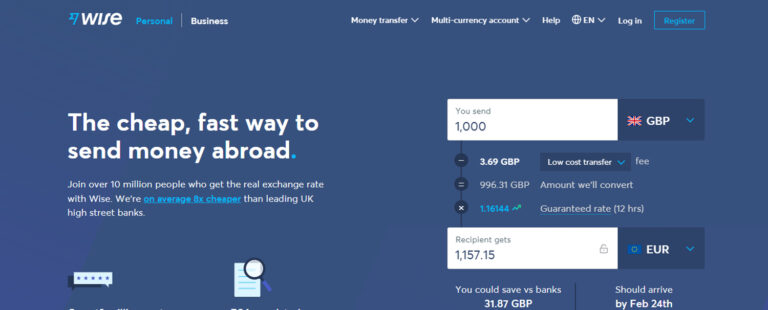

3. Wise

- Established: 2010 (formerly TransferWise)

- Pricing: For a USD to EUR transfer, Wise charges 0.6% of the transaction amount, plus $1.00.

This is a great option for businesses that process a lot of international transactions.

Wise provides the actual exchange rate, with no inflation or additional hidden fees.

Their multi-currency account service comes with a debit card (available in some countries) that enables you to manage money in more than 40 currencies.

You can run payroll, charge clients, batch payments, and more.

Sellers can also invoice customers in their own currency, avoiding confusion and providing a smooth transaction process.

It’s simple. Your international customers put money into their nation’s Wise account.

Then, Wise sends you the equivalent.

Money never crosses borders, so international transactions are extremely fast and easy.

4. Stripe

- Established: 2010

- Pricing: Similar to PayPal, Stripe charges 2.9% of the transaction amount, plus $0.30.

Stripe is a popular choice for business owners who want a flexible application programming interface (API).

This platform believes that payment problems are not based on finance, but on code.

As a result, they’re easy to customize and integrate into a variety of operating systems.

Stripe enables store owners to manage transactions from anywhere in the world.

They provide mobile payments and can deposit your funds directly into your bank account.

While Stripe is customizable and highly flexible, it’s best for store owners who have some background in computer programming.

5. Payoneer

- Established: 2005

- Pricing: Payoneer customers make payments for free. Customer credit cards are charged 3% and virtual checks are charged 1%.

Small and medium-sized businesses benefit the most from Payoneer, whose emphasis is on ecommerce, freelancing, vacation rentals, and online advertising.

Users who have an online account also receive a debit card, so funds can be withdrawn from banks or ATMs anywhere in the world.

Payoneer’s efficiency is second to none. Transactions are complete in just two hours!

6. Shopify Payments

- Established: 2013

- Pricing: A basic Shopify account plan begins at $29 per month. Credit cards are charged 2.9% plus $0.30.

Shopify is a popular ecommerce platform for more than a million store owners.

Shopify Payments enables these sellers to bypass third-party services and accept all major credit and debit card payments directly on their store.

Transaction details are synced with each Shopify order, so all of your data is gathered in one place.

It’s also highly versatile for shop owners and consumers and can be used with social media accounts, Amazon, and eBay.

As an added bonus, Shopify Payments converts to Shopify POS (point of sale), so sellers can use this same feature in their brick-and-mortar locations as well.

7. Authorize.net

- Established: 1996

- Pricing: Plans begin at $25 per month, with 2.9% plus $0.30 for each transaction.

This subsidiary of Visa is especially liked by small businesses.

Authorize.net is known for providing the best customer support in the industry.

Not only is it free, it’s offered by actual live people 24/7.

In addition to its security and reliability, sellers particularly love Authorize.net’s many services.

From recurring billing and POS checkout to invoicing and API, this provider meets the diverse needs of an ecommerce store owner.

Best of all, Authorize.net is highly intuitive so it’s easy to use, and it’s compatible with other payment providers like PayPal and Apple Checkout.

8. Braintree

- Established: 2007

- Pricing: Each transaction is charged 2.9% plus $0.30. Custom pricing options are available.

Although it’s technically a PayPal service, Braintree offers lots of features that PayPal doesn’t.

Designed for large businesses like Yelp and DropBox, Braintree’s main advantage is its focus on providing a seamless checkout experience for higher conversions.

This service enables sellers to accept online payments from more than 45 countries in more than 130 currencies.

While it offers standard features like hands-on customer support and recurring billing, it’s also highly customizable. This means you’ll need some programming knowledge to sync it with your ecommerce site.

9. 2CheckOut

- Established: 2006

- Pricing: While there are three pricing plans to meet your needs, transaction charges start at 2.9% plus $0.30.

Sellers who encounter a lot of international business really benefit from this service.

2CheckOut accepts 45 types of payment, 87 currencies, translates in 30 languages and is accessible in over 200 countries.

You’re able to customize the checkout experience to meet the needs of your international customers.

Security is always a concern with online payments, but even more so for international transactions.

2CheckOut is on the case. They provide more than 300 fraud checks on each transaction.

10. Dwolla

- Established: 2010

- Pricing: Starting plan charges 0.5% of the transaction total, with a $0.50 minimum and $5.00 maximum.

American ecommerce business owners enjoy a ton of benefits with Dwolla.

It provides highly reliable service, strong security, and a helpful customer service team.

Even better, it has a customizable API so businesses can personalize the branding in the checkout process.

These tools are easy to use and a great way to build your company identity and establish brand awareness.

Sellers who get a lot of bank transfers particularly benefit from Dwolla, as it specializes in ACH (Automated Clearing House) electronic bank-to-bank transfers.

11. QuickBooks Payments

- Established: 2001

- Pricing: The basic plan offers free bank transfers and cards are charged 2.9% plus $0.25.

QuickBooks Payments works best when bank accounts are linked with the QuickBooks accounting software. It simplifies financial tracking and keeps you from having to manually enter data.

QuickBooks Payments focuses on offering simple, user-friendly finance tools to small businesses.

Sellers can use it to build and send invoices, accept mobile card payments, perform ACH bank transfers, and schedule recurring billing and auto-pay reminders.

As if that wasn’t enough, you can manage employees more efficiently by syncing payments with timesheets and payroll.

12. Amazon Pay

- Established: 2007

- Pricing: Domestic US transactions charge 2.9% plus $0.30. International transactions charge 3.9% plus $0.30.

Amazon is already a trusted site with millions of users, so Amazon Pay is a great way to allow people to make online payments.

Users can just log into their accounts, click on their saved information, and check out with an interface they’re already familiar with.

This makes for a quick and painless checkout process, creating a positive user experience and boosting conversion rates.

Amazon Pay can be used on all devices, so sellers and customers can manage payments whenever and wherever is convenient.

Shop owners will need some programming knowledge to align Amazon Pay with their ecommerce sites.

13. Skrill

- Established: 2001

- Pricing: Transactions are charged 1.45% plus $0.50, but transferring funds to a bank account is free.

Skrill offers lots of conveniences for online shoppers.

They can store card information for quicker checkouts, link bank accounts, and make payments with a quick login.

A prepaid debit card lets users shop worldwide and transferring money to bank accounts is quick and easy.

Skrill was developed with cryptocurrencies like Bitcoin and Litecoin in mind and is designed for online gambling games that require money to play.

As a result, they have strict fraud prevention tools in place to protect user accounts. While this is great for security, it can also lead to frozen accounts if you’re not careful.

Pick a Plan that Makes Customers Happy

With ongoing technological advancements and ecommerce capabilities, there are tons of virtual payment options available to ecommerce sellers.

Whether you stick with PayPal or lean toward any of the alternatives on this list, keep in mind your ultimate goal is to provide the best user experience for your customers.

A payment provider affects this with:

Fees

There can be some pretty big discrepancies in processing fees among different payment services.

Really think about the number of transactions you anticipate, whether your audience is domestic or international, and what kind of payments you’ll accept. All of these can impact your costs.

Security

Online transactions require a heightened level of cybersecurity. People share personal information that, if fallen into the wrong hands, could lead to identity theft and financial ruin.

Make sure the payment company you use is reputable and goes to great lengths to encrypt and protect data.

Customer Service

As a store owner, transactional issues can bring your business to a grinding halt. You need to know that your payment provider will be available to help you through issues quickly, effectively, and get you back up and running in no time.

Think carefully about the tools you need to make your customers happy.

From employee management and inventory coordination to online transactions, every decision you make is driven by your customer.

Choose the payment service that most effectively helps you help your customers.

After all, that’s really what business is all about.

If you keep your customer at the front of your business decisions, you can’t go wrong.

More Resources:

- 5 of the Best Ecommerce Tools Every Merchant Needs

- Google Pay Becomes Google Plex to Manage Your Day-To-Day Finances

- Ecommerce Marketing: The Definitive Guide

Image Credits

All screenshots taken by author, February 2021

![AI Overviews: We Reverse-Engineered Them So You Don't Have To [+ What You Need To Do Next]](https://www.searchenginejournal.com/wp-content/uploads/2025/04/sidebar1x-455.png)