This post was sponsored by Directive Consulting. The opinions expressed in this article are the sponsor’s own.

At a standstill about how to best market your new tool?

Wishing you could accurately know which ads will return the highest qualified conversion rates?

Does reaching out to businesses often end in learning that they’re not a good fit for your company?

When it comes to SaaS marketing, the key to success is knowing what’s truly attainable with your tool’s features and solutions plus the audience that’s open and ready to buy a new tool.

So, who exactly are these potential B2B customers who are looking for your new tool amid the competition? Your Total Addressable Market (TAM).

Don’t know what a TAM is or how to create one? You’re not alone.

Using a TAM list for your advertising reduces that waste, assuring all your advertising dollars are spent on the right companies your sales team would love to talk with.

For the most powerful go-to-market strategy, your market differentiator will be clear when you consider your true, total addressable market to your SaaS marketing strategy.

In This Guide:

- 1. What Is A TAM?

- 2. How To Build A TAM List

- 3. Step 1: Create A Lookalike List Of Your Current VIP Customers

- 4. Step 2: Export “Look-A-Like Audience” Of Best-Fit Customers

- 5. Step 3: Manually Verifying Your Data

- 6. Step 4: Segment Your TAM List

- 7. Step 5: Aligning Your TAM With Your Go-To-Market Strategy

- 8. Create Your TAM & Use It

With this guide to creating, building, and knowing your TAM, your upgraded SaaS platform’s GTM strategy will be able to:

- Guide more productive resource allocation.

- Improve your budget allocation.

- Make more accurate pricing decisions.

- Guide strategic decisions.

- Create higher-converting advertising.

- Create your ultimate go-to-market strategy.

Understanding and creating your total addressable market, or TAM, is essential for any SaaS company.

If you’re a little uncertain, don’t worry; Directive’s own SaaS PPC experts finessed the exact process here for you. This is based on our own experience as well as hundreds of other SaaS businesses that have used this same process and are seeing serious results.

First, let’s understand what a TAM is and why it’s important.

What Is A TAM?

A Total Addressable Market (TAM) represents the potential market size for a particular product or service.

It identifies the factors that make up your best-fit customer base.

It looks at all businesses and individuals that could benefit from or have a need for your offering and afford your pricing based on:

- Demographic data.

- Geographic areas.

- Firmographic data.

- Technographic factors.

Why Is Building & Understanding Your TAM Important?

Understanding your TAM helps your business assess your growth potential and make informed decisions about market entry and resource allocation.

It’s important because it helps guide your go-to-market strategy.

TAM is a crucial concept in business strategy and market analysis as it helps companies gauge the total number of potential customers and the size of the revenue potential.

Most people use third-party data, such as industry targeting on platforms like LinkedIn and Facebook/Instagram, when advertising with paid social media. This approach is flawed because of how each platform categorizes companies in certain industries. This results in a lot of wasted spend on companies you could never work with.

Using a TAM list for your advertising reduces that waste, assuring all your advertising dollars are spent on the right companies your sales team would love to talk with.

How To Build A TAM List

It’s not a good idea to grab the entire market; instead, you should start with a bottom-up approach, looking at our best customers.

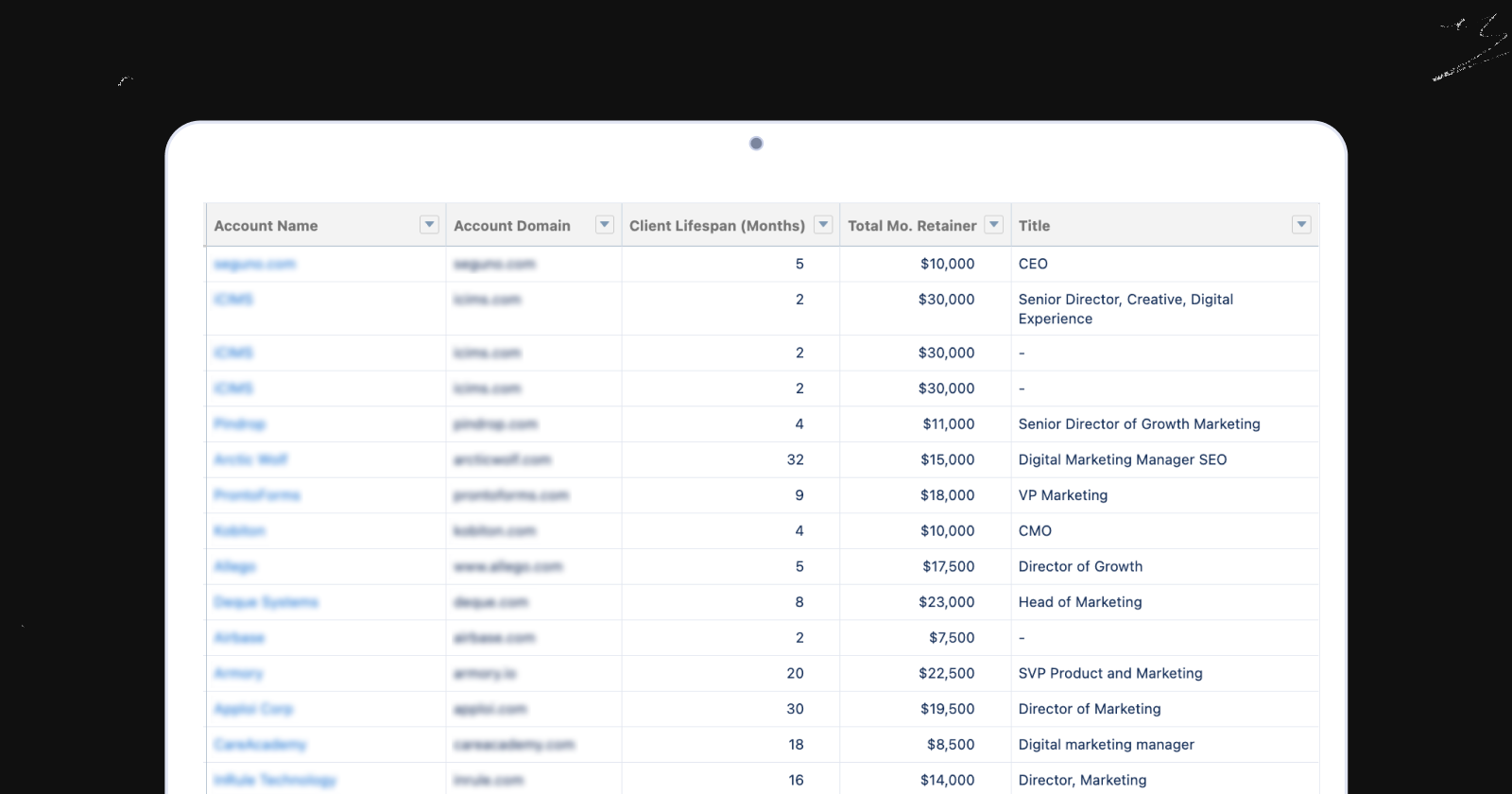

Step 1: Create A Lookalike List Of Your Current VIP Customers

When building a TAM, you first need to understand the criteria we’ll use to determine the total available market.

To do this, export a .csv list of your current customers with the following criteria:

- Company name.

- Company website.

- ACV (Average contract value).

- LTV (Lifetime value) or how long they’ve been a customer.

- Close rates.

- Any other information that would be helpful to determine the best customers such as NPS (net promoter score).

Note: If you don’t have enough customer data, you can pull late-stage opportunity companies to get a more extensive data pull.

Image created by Directive Consulting, October 2023

Image created by Directive Consulting, October 2023From there, you want to upload that list to any data provider such as Zoominfo, Clearbit, Apollo, or Crunchbase. There are many options to choose from, but you’ll want to choose the one best for you.

You’ll then want to upload that customer list (A CSV file) to the data provider of your choice.

Once uploaded to the data provider, append any data that would be helpful for your company. At the minimum, this should be:

- Company name.

- Company website and domain.

- Employee size.

- Industries (categories and tags).

- Revenue amount (Please note this is most accurate if your potential customers are public companies, private is often inaccurate).

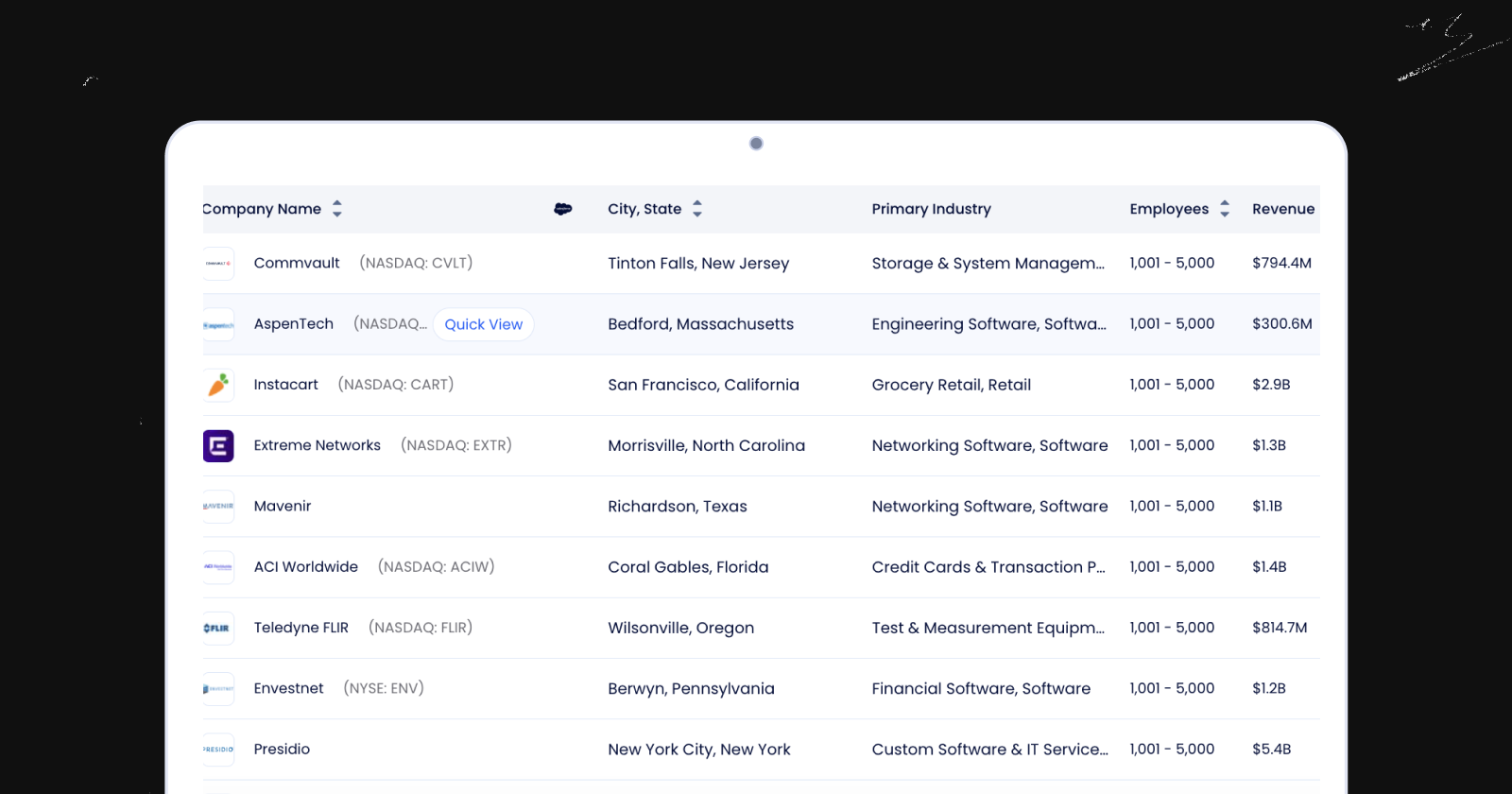

Image created by Directive Consulting, October 2023

Image created by Directive Consulting, October 2023Most of these data providers will also provide you with more data alongside the above.

Depending on your company, there are often other traits you’ll want to add in as a column as well, such as:

- Emails sent (If an email provider).

- IT tech spend.

- X department headcount.

- Funding rounds and amounts (Especially for software companies).

- Certain technology used.

Now we want to export it from the data provider and append it to your customer list so now you’ll have extra columns and data next to your customer list so you can see things such as ACV by employee size range and industries, highest LTV customers by IT tech spend or technology used.

Step 2: Export “Look-A-Like Audience” Of Best-Fit Customers

Now that you’ve determined your best-fit customer criteria, you will go back into the data provider and create a list of companies that fit that criteria.

Once you’ve found all the companies that fit that criteria, you want to export it and manually verify it’s correct.

Step 3: Manually Verifying Your Data

Now that you’ve exported the list of “look-a-like” companies from your data provider, the list building isn’t done.

We still need to go through each of them and manually verify them. This is because none of the data providers are perfect in how they classify industries and companies.

Download Template – See this template here of a TAM list set up with manual verification and tiering.

If you don’t go through and check each website, you’ll find companies that shouldn’t be in the industry you chose, we’re acquired, or the website redirects to another (Or worse, a 404 error).

Your marketing and sales teams can spearhead the manual verification process, or outsource it to VAs with precise instructions to help determine if the company fits within the criteria you chose.

Image created by Directive Consulting, October 2023

Image created by Directive Consulting, October 2023Don’t Skip The Manual Verification Process

Do not skip over this part of the process, as it is imperative. On average, across many data providers tested, we found that 50% of the companies on that list won’t be in the right industry.

This part is critical; if you don’t manually verify the data, you’ll waste a lot of ad spend and resources on companies you could never work with.

Step 4: Segment Your TAM List

After manually verifying your TAM, you’ll want to segment it into tiers. The number of tiers will depend on the size of your TAM and the criteria that make a better and higher ACV client. Less is more here, but you want to split the TAM into market segments to better allocate budget and resources.

For example, if you have 10,000 companies in your TAM list, you could split it into three tiers:

- Enterprise (Over 1,000 employee companies).

- Mid-Market ( 100 to 999 employee companies).

- SMB (Under 100 employees).

This split allows for better allocation of your budget within the advertising platforms, life cycle stage progression (As larger companies usually have a longer sales cycle), and sales routing (Ex: Enterprise accounts to Enterprise AEs).

Download Template – See this template here of a TAM list set up with manual verification and tiering.

Step 5: Aligning Your TAM With Your Go-To-Market Strategy

Now that you have your manually verified TAM list and segmented, you can use it in your go-to-market strategy.

This TAM list should be the backbone of your marketing strategy.

CRM Upload

The first thing you’ll want to do is upload it into your CRM and tag it with something like “Enterprise TAM, SMB TAM, etc. ” this way, everyone in your org will be able to see what accounts are in your TAM, engagement, market share taken as well as inform strategy.

Advertising

It’s a great idea to utilize this list in your paid social advertising. It’s best used with LinkedIn Conversation ads as you can upload the list and target these specific accounts, so you’re wasting your dollars on companies you can’t work with.

Nearly 50% of your ad spend is wasted pre-impressions if relying on industry targeting.

You can also do this in programmatic platforms that allow you to upload target accounts for the targeting.

You can also do this on Facebook and Instagram if using a B2B targeting tool such as Metadata, Clearbit advertising, or Say Primer, where you can import B2B audiences such as your TAM list into Meta for advertising.

Unfortunately, this isn’t possible with the current native targeting that Meta offers.

Create Your TAM & Use It

Creating a TAM is essential for any business, especially for B2B and technology companies. This market research guides every aspect of your go-to-market strategy to help you hit growth goals.

It requires some upfront work and hours, but you won’t regret it.

Need help building your TAM or, more importantly, using it in your go-to-market strategy to drive more pipeline and revenue? Our team at Directive would love to meet you 👋

Image Credits

Featured Image: Image by Directive Consulting Used with permission.

![How To Boost SaaS Go-To-Market Strategy: Build Your Total Addressable Market [Guide]](https://www.searchenginejournal.com/wp-content/uploads/2023/10/DC-SEJ-TAM-List-Article-wordless-creative_1.jpg)