While everyone is looking at AI Overviews, Google launched a personalized shopping experience to build a foothold in the vertical that’s the least sensitive to LLM disruption.

AI could revive personalization and bring it to other areas of Google as well.

The new SERP layout shakes up ecommerce SEO by making Google the new category page and shifting the focus to product pages.

[…] today, we’re introducing a transformed Google Shopping — rebuilt from the ground up with AI. We’ve paired the 45 billion product listings in Google’s Shopping Graph with Gemini models to transform the online shopping experience with a new, personalized shopping home, which is rolling out in the U.S. over the coming weeks, starting today. 1

Users can try the new experience out on shopping.google.com or the shopping tab. I see this as a test that could replace the default experience for shopping queries.

In reality, shopping SERPs have been transforming for a while. I wrote about it back in December 2023 in Ecommerce Shifts:

Google’s metamorphosis into a shopping marketplace is complete. Two ingredients were missing: product filters that turn pure search pages into ecommerce search pages and direct checkout. Those ingredients have now been added, and the cake has been baked.

In the same article, I highlighted why:

Reality is that Google had few options. Amazon had been eating their lunch with a growing ad business that hits Google where it hurts: ecommerce. Shopping is lucrative in part because conversions and returns are easier to measure than in industries like SaaS.

Two things changed since I published the article that explains the urgency of Google pushing into shopping:

- Google rolled AI Overviews out. In Phoenix, I outlined how often Google tried to personalize the search results without much success, but AI has a chance to make it work.

- TikTok has stepped into the ring with Amazon, encouraging merchants to livestream and advertise.2 Everyone was looking at TikTok as a search competitor to Google when former head of search Prabhakar Raghavan publicly mentioned that “nearly half of Gen Z is using Instagram and TikTok for search instead of Google,” but we missed how aggressively TikTok was pushing into ecommerce. If Google competes harder with Amazon and Amazon competes against TikTok, then TikTok is a stronger competitor to Google than originally assumed.

LLMs and AI Overviews likely disrupt informational searches by making many clicks obsolete, but ecommerce search is still alive and kicking and one of the main contributors to revenue growth.3

The exact impact of personalized, AI-based shopping Search will take a few more months to assess. But it makes a change in how Google:

- Looks for different verticals.

- Looks for different geos.

- Looks for different users.

- Aggregates websites.

Google’s Verticalization

Image Credit: Kevin Indig

Image Credit: Kevin IndigDifferent queries trigger different experiences on Google across shopping, travel, local and information.

Search for [mens shoes], and you get a shopping marketplace. Search for [best flight between chicago and nyc], and you get a flight booking engine. Et cetera. Et cetera.

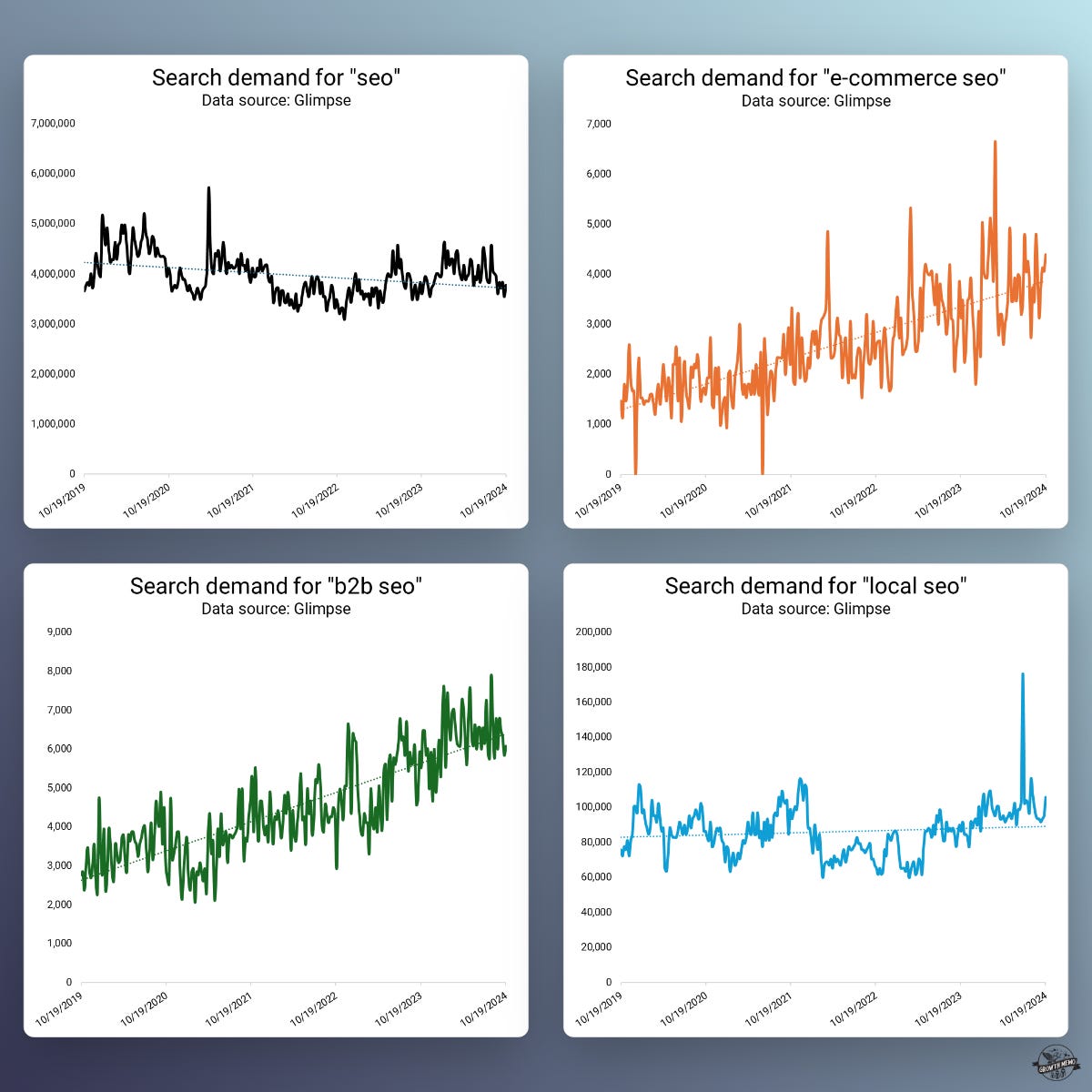

Google’s search demand for verticalized SEO reflects the trend: Searches for [seo] are flat while demand for verticalization, e.g., “B2B SEO,” is growing.

So, why do we still generalize SEO? There is no one SEO. There are many different types of SEO based on which vertical we talk about.

With different Google experiences grows the need to specialize skills by vertical. Ecommerce SEO, for example, centers around free listings and feed optimization in Google’s Merchant Center.

Our tools and insights are still far behind. There is no tool to run split tests for free listings in Merchant Center, but several tools handle feed optimization and experimentation for paid results.

Even worse, most companies still measure organic positions for success in ecommerce, but free listings show up above position 1 almost half of the time.4 Trend: growing.

Google’s Localization

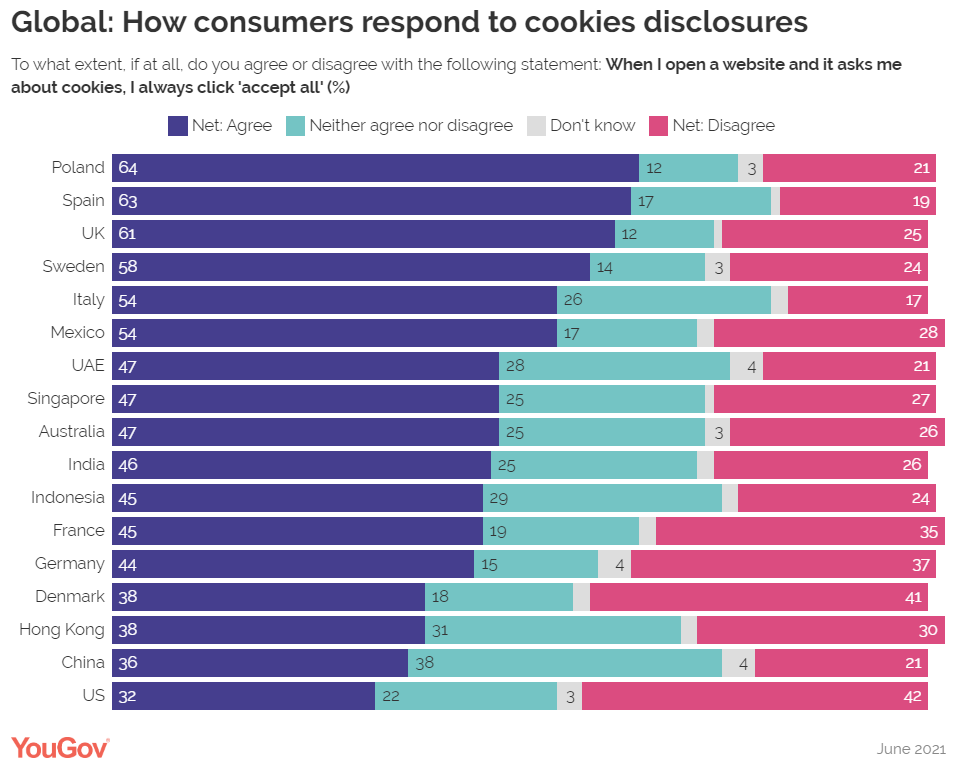

Source: YouGov

Source: YouGovGoogle’s experience in the EU is already different for verticals like travel.

From 2 Internets:

Regulation splits the internet experience, aka Search, into a European and American version with stark differences. While Big Tech companies face complexity, Search players have an opportunity to compare SERP Features and AI Overviews in both internet versions and better understand their impact.

AI Overviews have not yet rolled out in EU markets, and it’s unclear if they will.

Since the new shopping experience heavily leans on AI Overviews, I am equally skeptical that it will come to the EU, especially with the strong personalization layer.

Personalization under the Digital Marketing Act (DMA) is not forbidden, but GDPR mandates that users consent to it.

YouGov surveyed thousands of people across 17 countries and found vast discrepancies in consent.

Google will almost certainly “burry” consent in its general terms of service, which no one reads. It will be up to legislators to evaluate whether that’s sufficient.

Just like AIOs, the non-personalized shopping experience in the EU might serve as a comparison for the U.S. and other countries to understand the impact of Google’s new experience better.

Google’s Personalization

Image Credit: Kevin Indig

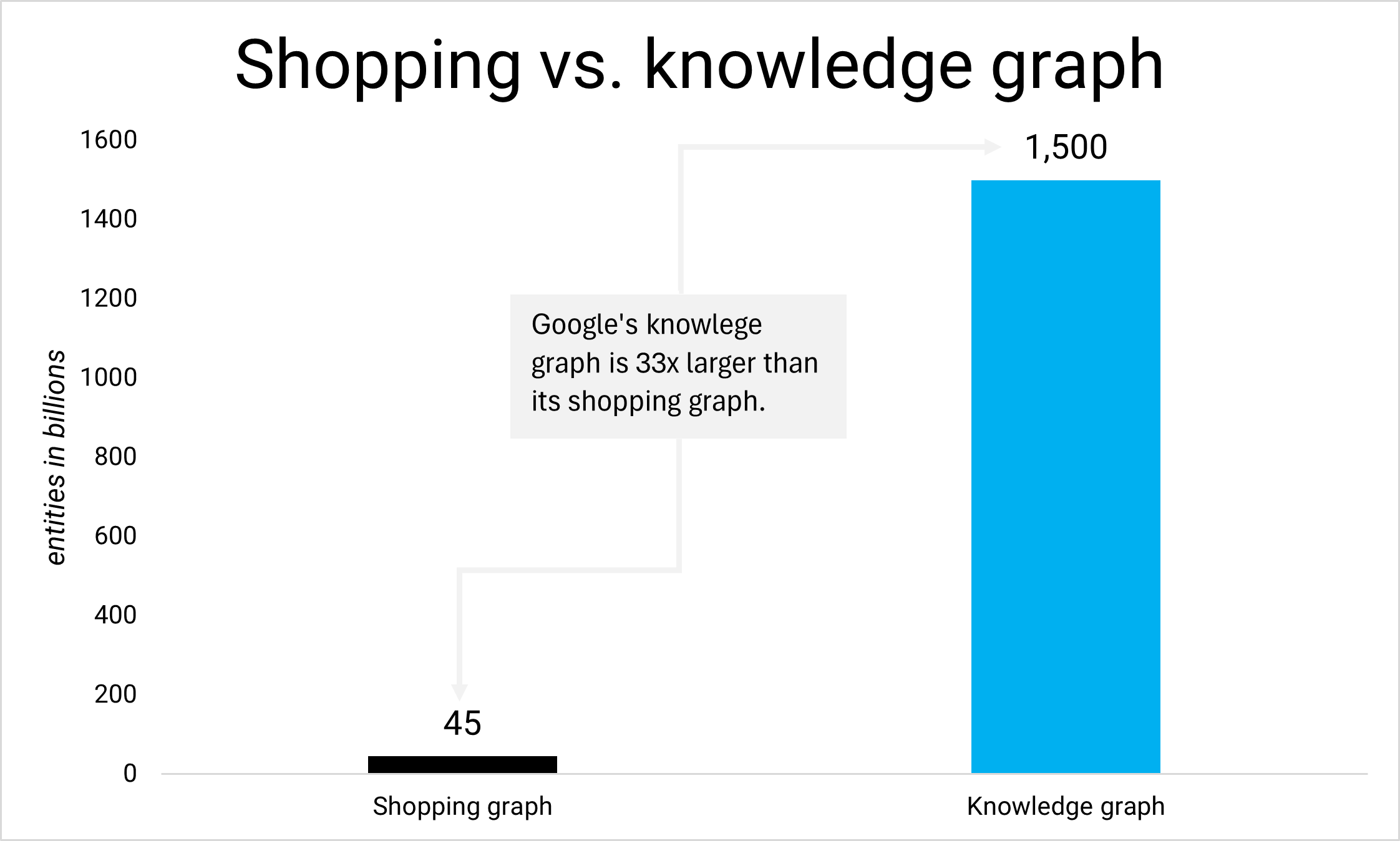

Image Credit: Kevin IndigGoogle personalizes the new shopping experience based on user behavior and matches it with its vast shopping graph that covers over 45 billion entities.

Note that 45 billion entities include product variations, reviews, brands, categories, and more.

However, the Shopping Graph looks like a dwarf compared to Google’s knowledge graph with over 1.5 trillion entities.

If personalization is a question of graph size and AI capabilities, it’s only a matter of time until non-shopping results are more personalized.

Personalization also makes sense in the context that AI can answer long questions much better than Google’s old semantic search ever could, so Google might as well personalize results based on behavior.

Google also uses YouTube as a source to personalize shopping. I wonder: why not for regular Search as well? ~25% of queries show videos, and most of those are from YouTube.5

Google could easily prefer videos from YouTube channels you subscribe to in the regular search results, as an example.

The challenge of personalization for marketers is optimizing for a uniform search experience.

When our experiences differ significantly, our data does as well, which means we’re losing a whole layer of insights to work with.

The result is that we need to rely more on aggregate data, post-purchase surveys and market research, like in the good ‘ol days.

Google’s Aggregation

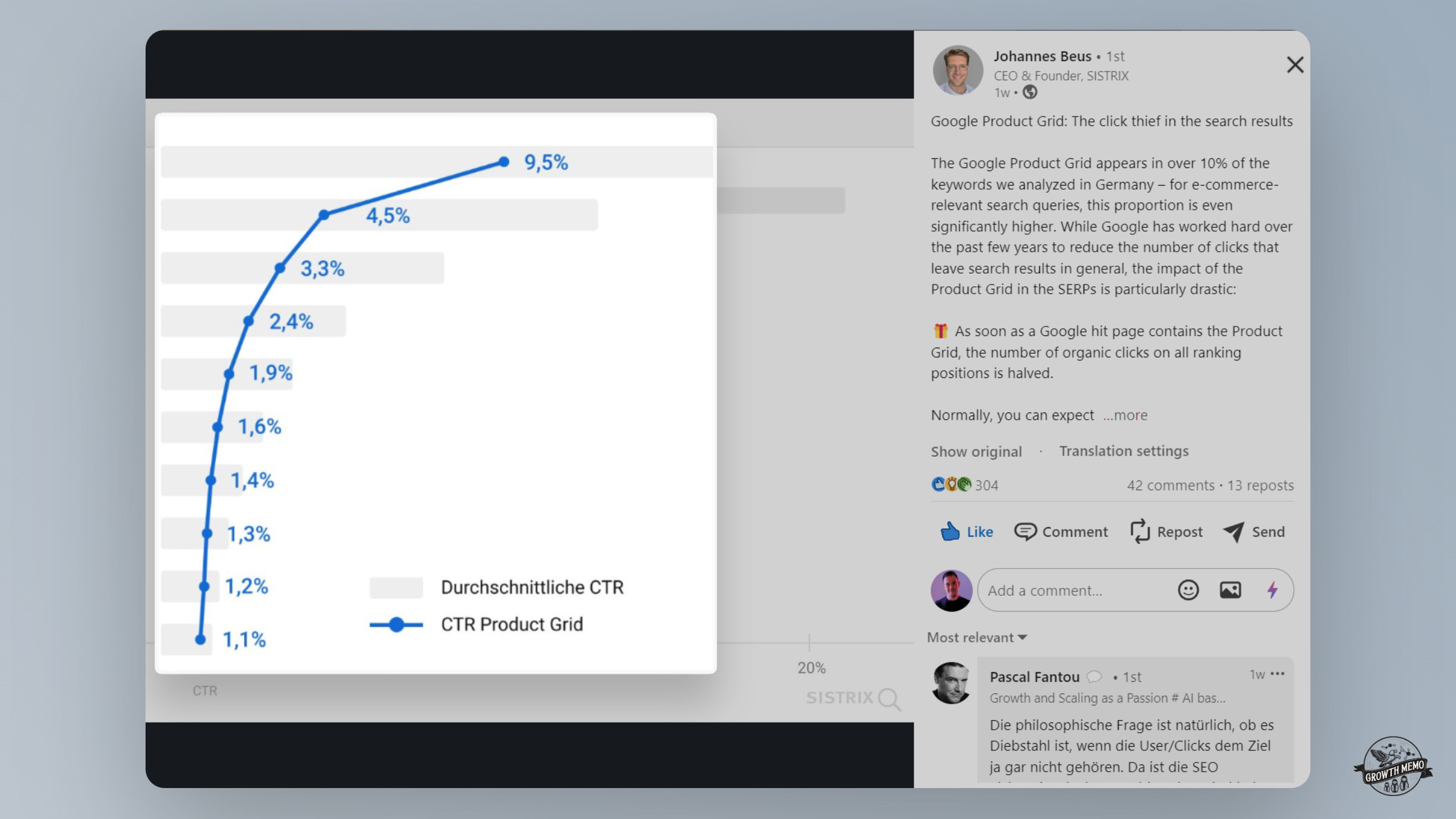

Free product listing click-through rates, according to Johannes Beus (link) Image Credit: Kevin Indig

Free product listing click-through rates, according to Johannes Beus (link) Image Credit: Kevin IndigThe big question, of course, is how this new experience impacts organic clicks. Can websites still get clicks? We don’t know for sure until more data rolls in.

One reference point comes from Johannes Beus (Founder/CEO of Sistrix), who found that Free Listings cut clicks on organic results in half, e.g., position 1 drops from ~21% on average to 9.5%.

But based on the layout and my experience with layout changes in the past, I will say that I don’t see a threat here. I see a change.

Google’s new layout for shopping SERPs, the one it has been using for a year now, is essentially a category page that lists products from online stores. As a result, the focus of ecommerce SEO shifts from category to product page optimization.

Where I do see a negative impact is for sites that provide price comparison, tracking, or discounts. Chrome has been tracking price changes for over a year.6

We know shoppers always want low prices, and the new Google Shopping not only includes deal-finding tools like price comparison, price insights and price tracking throughout, but also a new dedicated and personalized deals page where you can browse deals for you — just click the “Deals” link at the top of your page to explore.

We know Google uses Chrome data for ranking due to leaked documents and court trials.

I wouldn’t be shocked to hear that Google also uses Chrome data to inform the shopping graph and product recommendation in the personalized shopping experience.

If so, separating Chrome from Google in the context of the antitrust trial would also impact its personalization capabilities.

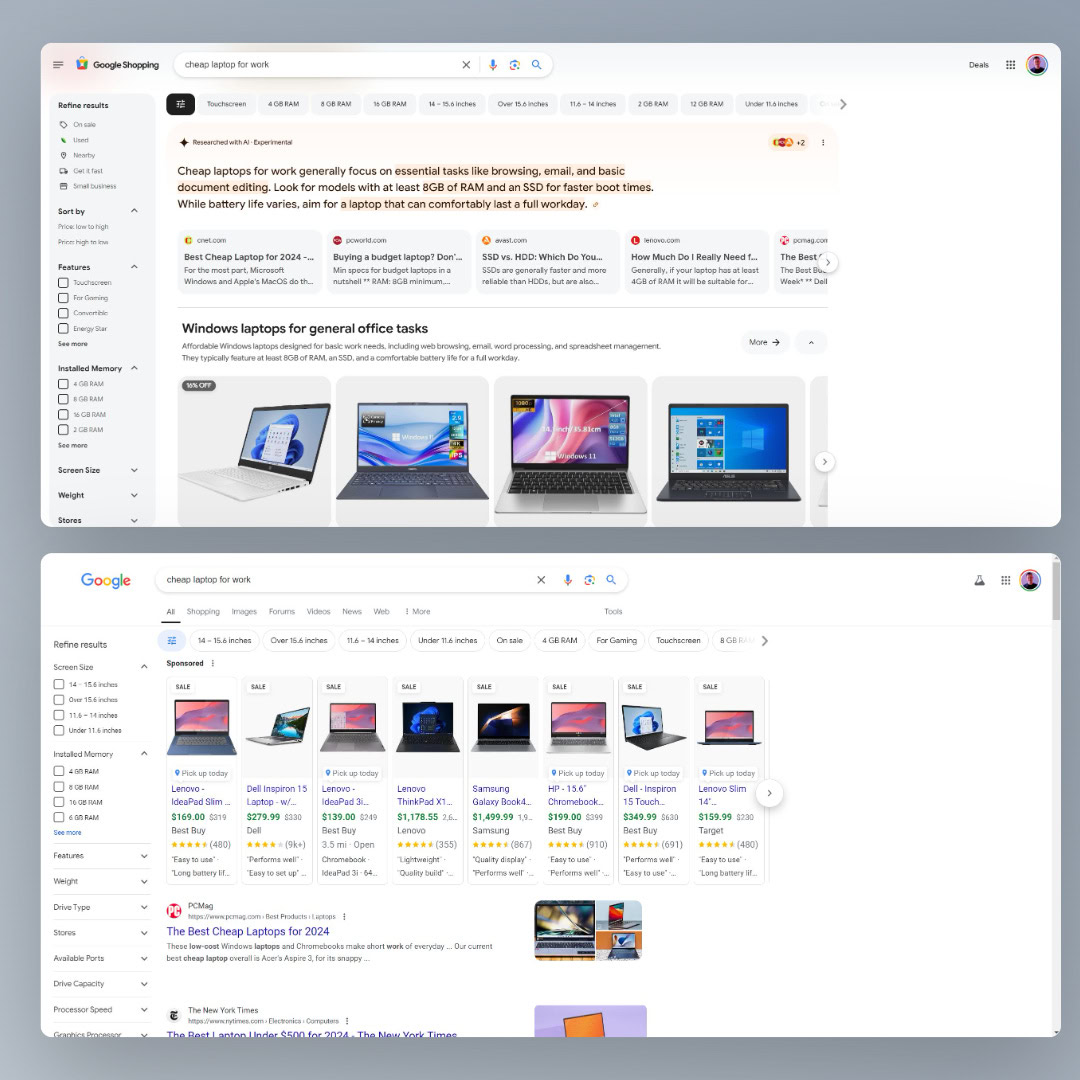

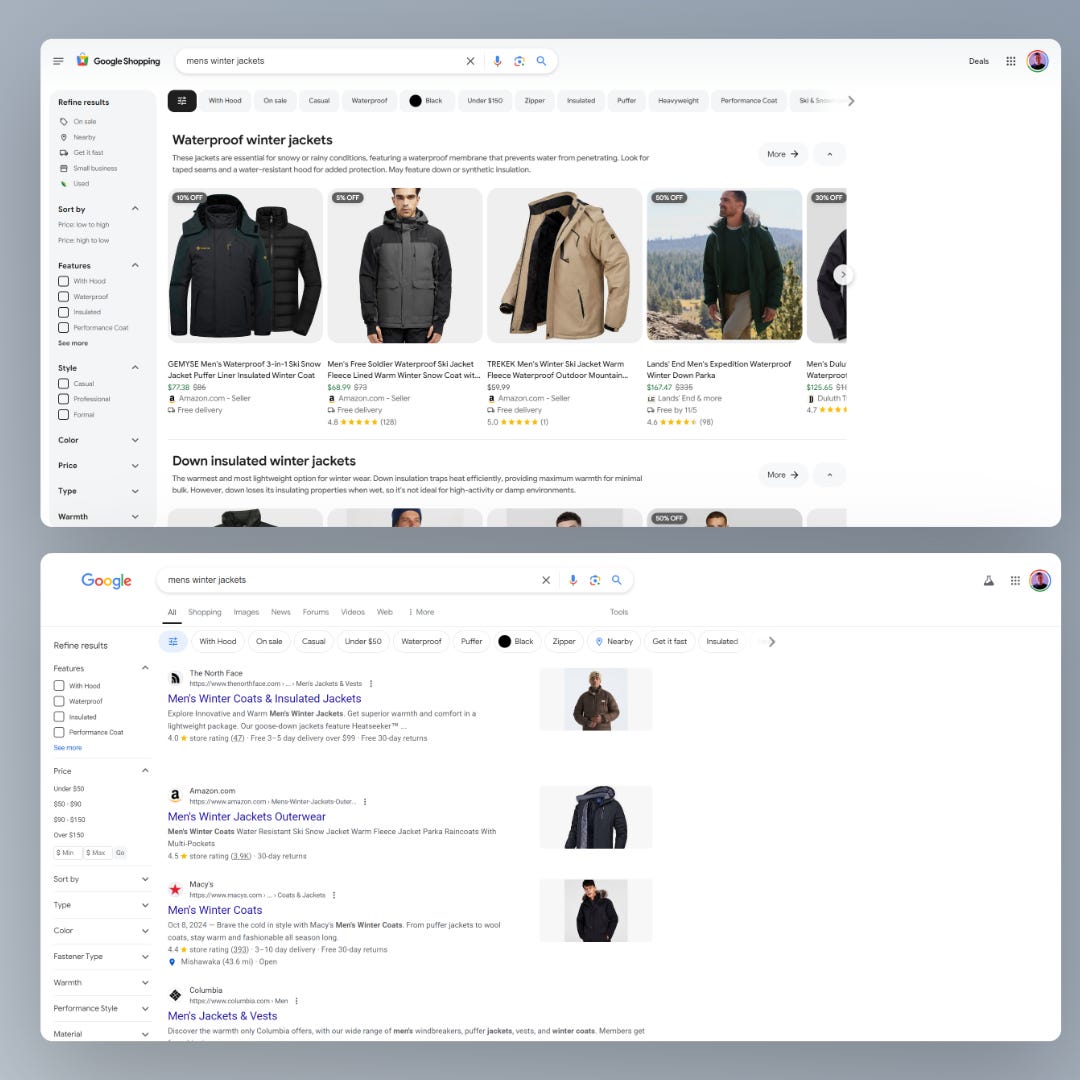

Above: “shopping tab” with Google’s new shopping experience; below: “all” tab (Image Credit: Kevin Indig)

Above: “shopping tab” with Google’s new shopping experience; below: “all” tab (Image Credit: Kevin Indig) Image Credit: Kevin Indig

Image Credit: Kevin IndigOne improvement from the new experience is that editorial content doesn’t have to fight with product or category pages over positions anymore.

The layout constantly changes, but it seems some queries highlight links to editorial articles about products (like “cheap laptop for work”), others (like “mens winter jackets”) don’t.

At least, there seems to be a lifeline for publishers in ecommerce.

Boost your skills with Growth Memo’s weekly expert insights. Subscribe for Free!

1 Google Shopping’s getting a big transformation

2 TikTok Tries to Woo American Shoppers, One Livestream at a Time

3 Online commerce helped boost digital ad platforms like Meta and Google

4 Critical SERP Features of Google’s shopping marketplace

5 Mozcast: Google SERP Features

6 Shopping insights & price tracking in Chrome

Featured Image: Paulo Bobita/Search Engine Journal

![[SEO, PPC & Attribution] Unlocking The Power Of Offline Marketing In A Digital World](https://www.searchenginejournal.com/wp-content/uploads/2025/03/sidebar1x-534.png)