If you follow me on Twitter, you know I am a harsh critic of those New York Jets and an unsolicited commentator on all things Real Housewives.

But you may have also realized I am a tireless fighter for SEM audience and asset segmentation.

Brand vs. non-brand, first-time consumer vs. repeat visitor, high HHI (high household income) earner women age 25–35 vs. age 65+ coupon shoppers… every element and audience is different.

It makes no sense to hold everything to the same standard for measurement.

One may say, “Jon, I have an aggregate goal. I expect all efforts to hit it. Otherwise, it just isn’t worth running them.”

To which I reply, “Well, riddle me this. How much cheaper is your brand CPC vs. your non-brand, or how much higher is a repeat shoppers conversion rate than a first-timer?”

While you can have an aggregate goal, you still need to realize that every element will perform differently.

Moreover, the different performance levels must combine to funnel into a single performance KPI (Key Performance Indicator).

If you proceeded with nixing all efforts that didn’t meet the aggregate KPI you set across the board, you will fail to garner new customers, and you’ll quickly have a diminishing level of traffic.

Need Proof? Well, Here You Go

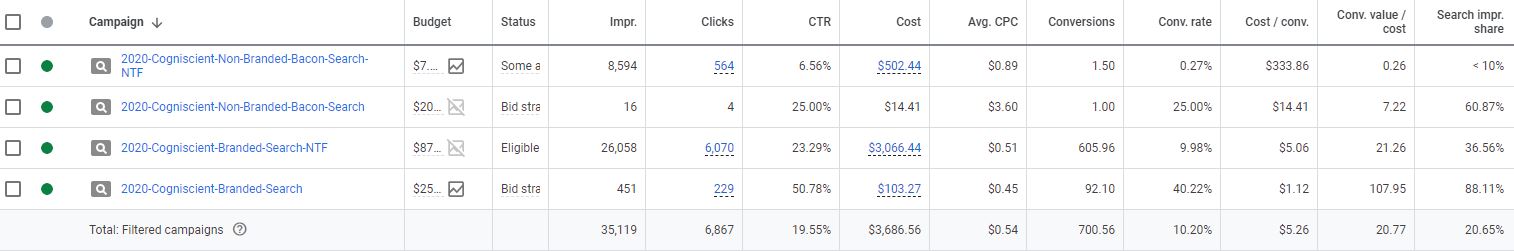

Here we observe “client N.”

They are a direct-to-consumer ecommerce brand that sells bacon and assorted smoked meats (yes, it is delicious).

We segment targets on the basic brand vs. non-brand, but also by NTF (first-time purchasers) vs. repeat purchasers.

-

Literally how the bacon gets made…in search.

Literally how the bacon gets made…in search.

Our AOV (Average Order Value) is pricing dependent, which is market price dependent, so we focus on maximizing conversion over ROAS (Return On Ad Spend).

We know that we’ll get two to three purchases per year for five years from a customer in a lifetime.

So while getting repeat purchases on our brand is super cost-efficient and pays the bills, we recognize they are now considered a depreciating asset.

As a marketer, do you push heavy on the depreciating assets because it is low cost, or do you pay out the wazoo for a new customer upfront, realizing they will become super cost-efficient on the second purchase?

Spoiler: Never stop supporting the repeat customer, but push hard for the first-time customer.

Because of this, we have six different KPIs (and their reasons):

Brand Repeat

- Low-level CPC KPI.

- Why: They are brand loyal, with a high probability of purchasing, so we want to get the CPC (Cost Per Click) as low as possible to direct them to the product we want to push.

Brand NTF

- High traffic KPI & Mid-level CPC KPI.

- Why: Brand aware, usually a receiver of gift or other marketing, high conversion probability, CPC is pricier, so if we can control it, it’ll be a better LTV ROAS.

Non-Brand Repeat

- CPA (Cost Per Action) KPI.

- They have no loyalty, they purchased once before but didn’t come back to us by name, so it is more logical to focus on a specific CPA target because another purchase after this is much less likely.

- Important to note that this is the least valuable customer and shows a lack of brand loyalty.

Non-Brand NTF

- High Traffic & High Impression Share KPI.

- You want as many of these as possible, and in a crowded marketplace, you often have to surrender cost (because this will not be cheap) for visibility (make sure you have a great ad in place.

- You’ll compensate on the back end for a conversion.

Shopping (We Don’t Separate NTF From Repeat)

- Conversion volume & ROAS KPI.

- This is our moneymaker after brand. Max out your sales volume as much as you can. Clicks are cheaper given the ad unit. Just make sure you don’t dip below a 110% ROAS.

Display/Video

- Brand Awareness KPI.

- This isn’t getting us direct sales. It builds brand awareness, so we do the lowest CPV on our 30-second videos and CPM (Cost Per 1,000 Impressions) on our display and test it regionally to determine the level of inbound first-time brand visitors to the site.

- We harvest the visitors for remarketing.

Another example is “client S.”

They are a chain of senior living communities around the country.

Their focus is on lead generation via form submissions or phone calls of a certain duration.

As always, we sort by brand and non-brand keywords and services provided. Each service has a different lifetime valuation as recurring revenue.

Independent living has a higher volume, longer LTV duration, and lower revenue per resident.

While at the other end of the spectrum, Memory Care is the lowest volume and shorter LTV duration but has the highest initial revenue in the first three years.

-

Understanding the SEM related valuation of senior living services

Understanding the SEM related valuation of senior living services

In this scenario, we set the KPI by the service line (ignore the lack of brand traffic, it isn’t as concerning for us as each location has a different name).

We operate with three different KPIs:

Independent Living

- High Traffic and mid-low CPC KPI.

- An immense amount of competition, so if you have a good price and a good location, the goal is pure volume. But if the CPC rises (from the competition) above $11, there is a quick chance that clicks fall off a cliff, as there is no additional budget.

Memory Care

- CPA KPI.

- Least amount of competition, but a high degree of researchers, which reduces CTR (Clickthrough Rate) and increases CPC. The key is to focus on the CPA itself with the realization the LTV duration is 25% of Independent Living. The revenue in three years in Memory Care exceeds that of eight years in Independent Living.

Assisted Living

- Low CPC KPI.

- There is a lot of competition, and everyone gets seen as a lot of research goes into this. You don’t have to be in position 1, just be visible, and get the traffic for as little as possible, because, with fixed budgets, a CPC swing of $0.50 can cut your traffic down.

Okay, I’ve Seen Your Proof. Now What?

Once we’ve identified the necessary KPIs, we set the target numbers each to achieve.

This means, things like “Brand Repeat CPC cannot exceed $0.50” or “Non-Brand NTF needs to drive at least 250 clicks per week with an impression share of 15%, and a CPC not exceeding $0.75”.

We then divide the budget from what is most valuable to us to the least for budget distribution.

Then we can determine if the budget allocation will meet the aggregate ROAS objectives.

Takeaway

No two accounts are alike (it’s like calling the Jets and the Giants the same NFL team).

But that being said, not every asset in an account is the same.

Therefore, holding a non-brand first-time searcher of Cherrywood Bacon to the same CTR, CPC, CVR (Conversion Rate), and ROAS of a repeat buy on brand terms buying corned beef hash is like comparing apples to oranges.

Maintaining separate KPI targets, strategies, and elements will lead to a more accurate and predictable performance outcome.

More resources:

- The 6 Most Important PPC KPIs You Should Be Tracking

- How Impression-Based KPIs Drive Campaign Performance

- PPC 101: A Complete Guide to Pay-Per-Click Marketing Basics

Featured Image: idea Ink Design/Shutterstock

![[SEO, PPC & Attribution] Unlocking The Power Of Offline Marketing In A Digital World](https://www.searchenginejournal.com/wp-content/uploads/2025/03/sidebar1x-534.png)