As e-commerce business brokers, we get to see and value a wide range of e-commerce businesses, both good and others not so good. Owners come to us in every situation possible. Growing, declining, and anywhere in between, so we get to see a lot of different businesses. Typically e-commerce entrepreneurs approach us wondering what their business is worth and what it may sell for. Based off that experience and data, we believe the following eight factors make a million dollar e-commerce business:

1. Profit

The number one driving factor of a million dollar e-commerce business is profit. The accepted valuation approach for e-commerce businesses is a multiple of earnings valuation methodology. What this means is the value of an e-commerce business will be a multiple of the profit the business makes. A buyer will likely pay 2-3 times earnings. This means your e-commerce business has to be making between $333,000 to $500,000 in net profit per year to be valued over $1 million dollars.

There are many factors that will alter what multiple is paid, therefore it’s important to get a proper valuation to determine the true value of your e-commerce business. We will use 2-3 times as the benchmark valuation multiple for business under $5 million sold on the open market.

Factors brokers use to determine what multiple is paid include:

- Profit

- Growth

- Website Traffic

- Brand

- Business Model

- Income Streams

- Age

- Business Risks

2. Growth

If you had three example businesses: one growing, one that was stable, and one that was declining, the growing business is going to demand the highest price. This is best represented in the graph below. Sell when your site is growing or at the early states of maturity.

Image created by author

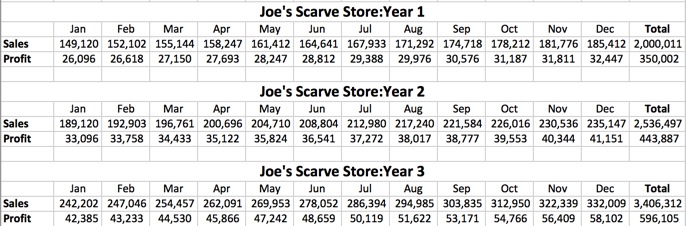

The reasons buyers pay more for a growing business is they can see future upside and a quicker return on investment. The general assumption buyers make when looking at financials is assuming a baseline trend and then projecting that trend into the future. Let’s take this example. Joe has an e-commerce store selling scarves. His store did $2,000,000 in sales in the last 12 months and $350,000 in net profit. Joe’s business has been steadily growing at 2% per month for the last 12 months. Here is what his projected business looks like:

Image create by author

Let’s say you put the business for sale for a 3X multiple which would give a valuation of $1,050,000. A buyer would then project using the past 12 months figures that the business will make $443,000 profit in year two and $596,000 profit in year three. Essentially allowing a buyer to make their money back in two years.

What this is going to do if you are looking to sell is:

- You are more likely to get a quicker deal

- You will possibly get a higher offer

What you have to remember though, is nothing in business is guaranteed. You might be sitting there thinking, if this is going to happen in my business, why not hold onto it? The likelihood that a business grows in this linear fashion is improbable, however what it does give you is a look into the mindset of how a buyer thinks about acquisitions and valuations. Their main motivation is “How can I get my money back and can I make that return on investment quicker?” This will influence the valuation that they come up with for a business.

3.Table Selection

Table selection is a poker term that relates to choosing a table to play at, where the players are worse than you, therefore you ultimately make more money. How this relates to e-commerce businesses is choosing a niche where there is growth, high margins, and a defensible market position which will ultimately improve your likelihood of a higher valuation.

A real world example of this is a toy e-commerce store we valued that was selling racing car products for kids. The business did extremely well for the two years after the toy was released, however it started to decline sharply as the product went out of demand. By operating in a market that has evergreen or growing demand your business is more likely to be able to get to a million dollar valuation.

4. Age

The Internet is young, technology changes, and things come in and out of fashion very quickly that if you have a business that is one to two years old you are going to get a drastically lower price than something that is over five years old. Generally the older the business, the more data and earnings history and the lower the perceived risk of the business failing and the higher the valuation.

5. Defensibility

The more defensible your business, the higher the price. By defensible we mean barriers to entry, the stability of your income, traffic, and supplier sources.

Dropship Versus Warehouse

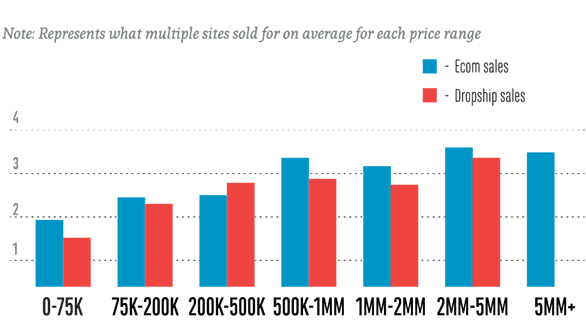

Data doesn’t lie. A warehouse based e-commerce business model is more valuable than a dropship based business model. As you can see from the graph extracted from our e-commerce business valuations report, the multiple paid for dropshipping websites is much lower. Dropship e-commerce stores are very easy to replicate and have low barriers to entry. That is why it helps to have your own products that you have designed and developed or be known as the “go to” supplier in a specific niche.

The main reasons for a higher valuation for a warehouse based e-commerce business:

- Control Supply Chain

- Manufacture Branded Products

- Higher Margins

- Ability to Incorporate More Paid Traffic

- More Established

- Scalability

Image created by author

Paid Versus Organic

If your e-commerce store relies solely on organic web traffic, then you are going to receive a lower valuation than if it has multiple traffic streams. The above graph shows that drop-ship e-commerce businesses sell for less. 90% of drop-ship websites rely solely on organic traffic. There is a direct correlation between these two observations.

We use this analogy; by relying on one leg of a table to support it’s weight you are increasing the risk of the business. If that leg get’s taken away then your table (business) collapses. By being solely reliant on one traffic source, particularly on the discretion of Google, is a losing game to play. Whole businesses have been destroyed with one algorithm update. That is why it is important to have more than one channel of traffic driving visitors and sales to your e-commerce store.

6. Systems

Especially with e-commerce stores, it is the systems and processes in both operations and marketing that increases value. Technically, with enough effort someone can set up a competing store in your niche with a little hard work and sweat equity. So it is not the idea and business that creates value, it is the systems and processes that run a business that have value.

Operational systems such as automation will help you fetch a higher price for your business. The less human elements in your business, the higher the amount a buyer is going to pay.

Similarly if you have an identifiable, traceable, and repeating marketing system for your business (not just solely relying on Google organic traffic) then you have a more valuable business. Integrating repeatable and profitable paid traffic sources will certainly ad value.

7. Clean Books

Poorly formed or non-existent financials will be a big problem for a potential buyer. The first two questions 99% of buyer will ask are:

- 1) What is the gross earnings?

- 2) What is the net profit?

And if you have no way of proving this, then it is going to be hard to value your business. Having all that information collected beforehand will ensure a smooth and speedy transaction.

Too help this process sometimes it’s a good idea to pay taxes. Who knew? What I mean is that instead of writing off every single expense in your business it’s a good idea to run your business lean for one year to show the true operating profit of your company for buyers, not for the tax man. What I just described is the perfect case scenario but isn’t always possible. So what needs to be done is to calculate the true net profit of your business. Even if you haven’t run your business lean for the last 12 months, there are ways of calculating the true operating profit and loss of your business in order to increase its valuation. This is something a broker does when providing a valuation on your business.

8. Which Platform is Best?

There is no conclusive data that suggests which platform is best. There are multiple reviews on the pros and cons of each e-commerce platform you can read online, however from a business sales perspective there is not enough data to come to a conclusive outcome.

Because profit is the main driver of valuation, we need to be objective when determining which platform will assist you in generating more profit. This comes down to the metrics of an e-commerce business. Does the platform allow you to tweak performance of the site to increase profitability?

Image created by author

Smart buyers want to know metrics and a solid platform (shopify, magento, bigcommerce) will already be designed to help you improve your metrics. And generally smart buyers pay a premium to the market because they can calculate the future potential of a business (what is really being sold) that is why it is important as a store owner to know your metrics and have tracking mechanisms in place. Whether they are automatic (analytics) or manual (spread sheets) tracking the following elements will improve your site’s profitability now and increase the likelihood of a higher valuation when you are selling. Things to monitor include:

- Conversion Rate

- Subscriber Growth Rate

- Value Per Visitor

- Average Order Size

- Cart Abandonment Rate

- % Returning customers

Of course, there are always going to be outliers and other factors that alter an e-commerce stores’ value. However, if you use the above eight recommendations as a baseline, you will likely find your valuation above the million dollar mark.

Featured image by author.

![[SEO, PPC & Attribution] Unlocking The Power Of Offline Marketing In A Digital World](https://www.searchenginejournal.com/wp-content/uploads/2025/03/sidebar1x-534.png)